Insurance decisions shape the world,

we help insurers make better ones

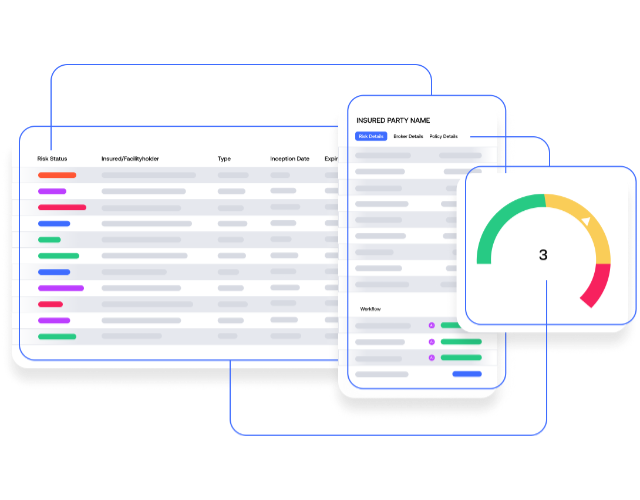

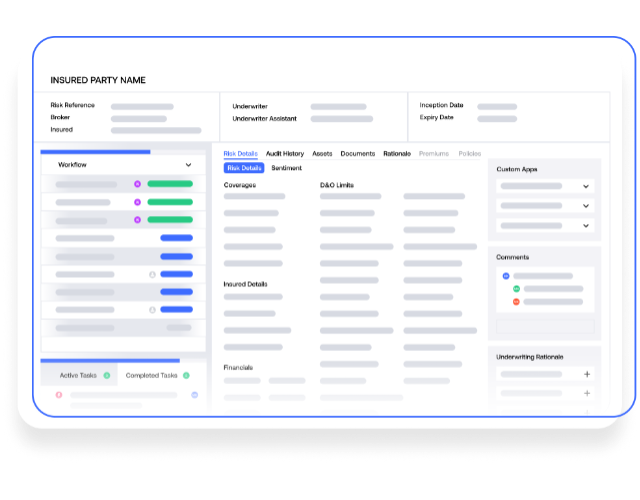

Insurers don’t want siloed systems. Send is the leading orchestration engine that connects underwriting data, workflows and decisions for commercial and specialty insurers.

Trusted by insurers and MGAs all over the world

One platform to manage underwriting from submission to bind, and beyond.

Solutions

Insurers

A data-driven underwriting platform built for complex commercial and specialty risks.

MGAs

One platform from quote to renewal, with the control and reporting capacity partners expect.

Reinsurers

The underwriting backbone for reinsurers – bringing structure, pricing, and insight together in one place.

Platform Metrics

Products

Send for Direct Underwriting

Designed for insurers and MGAs writing open market business.

Send for Delegated Underwriting

Purpose-built to help insurers scale delegated business with confidence.

Send for Reinsurance Underwriting

The smarter way to structure and manage reinsurance programmes.

Combining the art and science of underwriting.

Platform capabilities.

Carriers are looking for a platform that can accommodate a wide range of strategies and operating models.

You want to do things differently, so do we. Our platform orchestrates insurance workflows, tasks and decisions to help you win better business, faster.

Activity Management

Capture decisions, track tasks, and coordinate workflows in one place to keep teams aligned and nothing missed.

Automation & Rules

Automate manual work, guide decisions with clear rules, and keep submissions flowing through configurable workflows connected to your wider ecosystem.

Binder Management

Set up binding authority agreements, manage reviews, and control approvals in one central workflow built around your due-diligence needs.

Bordereaux Ingestion

Ingest bordereaux, validate contract terms, and standardise data in one workflow to give you a clear, consistent view of delegated business.

Data & Insights

Bring data together to generate insights and track performance in real time for clearer, more confident underwriting decisions.

Entity Management

Onboard entities, manage relationships, and centralise all parties in one place for clearer oversight across the underwriting lifecycle.

Post-Bind Processing

Push bound policies to downstream systems or package them as bordereaux, making post-bind processing simple for insurers, MGAs, and coverholders.

Quote & Rate Lifecycle Management

Create quotes, compare options, and manage approvals in one place with full version control and a seamless transition from quote to bind.

Risk Workflow

Automate compliance checks, validate contract terms, and capture full audit trails so underwriting stays fast, controlled, and regulatory-ready.

Submission Management

Organise submissions and quickly prioritise risks in appetite to speed up response times and improve your submission-to-quote ratio.