Top 10 insurance industry trends shaping underwriting in 2026

Introduction

If 2025 was a year of transition, then 2026 is set to be a year of hyper-acceleration for the global commercial and specialty insurance market, as an evolving set of pressures continues to reshape underwriting fundamentally.

Looking back, several of the trends we identified last year have matured significantly. We talked about the shift to portfolio underwriting, and in the last 12 months, we have seen more carriers embracing data-driven, algorithmic approaches to risk selection. The AI assistants and hybrid teams we envisioned are no longer aspirational; they’re here, embedded and actively supporting underwriting teams. The talent challenge, which has been a feature of our past two underwriting trend reports, has evolved rather than resolved. Though the market has continued its efforts to attract new talent, are we now too focused on the ‘next generation’ rather than the skills to empower our existing people and transfer vital knowledge and insight to an incoming workforce?

As 2026 begins, rate pressures are mounting across multiple commercial and specialty lines as the soft market cycle deepens. However, pockets of firming persist in casualty, legal liability classes, and complex construction risks. Underwriters are faced with the challenge of maintaining the impressive combined operating ratios achieved during the Covid-era hard market, even as pricing power diminishes and competition intensifies. We’re seeing an increase in multi-channel distribution strategies as carriers seek to diversify income streams, from delegated authority arrangements and broker facilities to various fundamental changes in broker-carrier relationships, all largely facilitated by technology.

Geo-economic fragmentation – the breaking up of global trade into competing blocs – continues to intensify, with 82% of chief economists expecting this trend to accelerate through 2026. This fragmentation doesn’t just create new risks; it undermines our collective ability to address them, driving demand for specialised products while simultaneously making it harder for insurers to diversify globally.

Meanwhile, regulatory scrutiny is tightening with the Dynamic General Insurance Stress Test and the EU AI Act demanding greater transparency and governance in the UK, while decentralised regulation in the US presents a more nuanced landscape for underwriters to navigate.

Climate change and extreme weather events continue to shock the market with their increased frequency and severity. Shortly after the publication of our 2025 Underwriting Trends report, wildfires erupted in Los Angeles, with combined insurance losses estimated to be $40bn, one of the costliest fires in global history. Severe convective storm activity across the US has continued to generate significant insured losses, adding to the mounting financial impact of climate change on the insurance industry.

However, despite these losses in the early part of the year, recent data from AM Best points to significant underwriting gains for 2025, largely due to “muted” catastrophe losses in the third quarter. It remains to be seen how these results will carry over into 2026.

The reinsurance market faces its own challenges, with M&A activity expected to surge as organic growth slows, a consolidation that brings both opportunity and operational complexity, particularly around integrating fragmented systems and siloed data.

Yet amid these pressures, there are reasons for optimism. The ability to harness data is accelerating product innovation to address protection gaps, while investment in InsurTech, particularly underwriting solutions and claims processes, is soaring as carriers battle to remain competitive using technology to their advantage. The key question for 2026 is whether the industry can get the basics of connectivity, data standardisation and ingestion, and operational foundations right whilst simultaneously innovating at the speed the market demands.

Summary of trends:

- TREND 1: Softening rates are testing underwriting discipline

- TREND 2: Insurance operating models are being rebuilt

- TREND 3: Fragmentation defines the global risk landscape

- TREND 4: Operational fundamentals are no longer optional

- TREND 5: Connectivity between the broker and carrier becomes indispensable

- TREND 6: The underwriting talent pipeline is being reshaped

- TREND 7: Reinsurance enters its next era

- TREND 8: AI moves from hype to underwriting impact

- TREND 9: Parametric solutions narrow the protection gap

- TREND 10: Regulation becomes a strategic pressure point

TREND 1:

Softening rates are testing underwriting discipline

In our 2025 underwriting trends report, we spoke of a market that showed “pockets of softening” with other lines remaining “stubbornly hard”. As we enter 2026, however, although there are still some remaining hard lines of business, overall, we’re seeing a much softer market both in the US and the UK.

In the WTW “Insurance Marketplace Realities 2026” report, focused on over thirty lines of insurance across North America, experts commented that:

“Today, nearly every commercial line of insurance — aside from excess casualty — finds itself in soft-market territory. For buyers, this creates a rare window of opportunity: expanding coverage, enhancing structural positions and re-examining your portfolio through the lens of a broader and more flexible market.”

This shift towards a soft cycle was also acknowledged by Chief Underwriting Officer for Lloyd’s, Rachel Turk, who was quoted in December as saying: “Lloyd’s underwriters must manage the inevitable slide toward the softest part of the underwriting cycle.”

This is certainly the case when looking at some of our customers’ biggest lines of business:

- Property – soft or softening, barring major catastrophe activity occurring in 2026, which, in the current climate, certainly cannot be ruled out.

- Construction – mostly soft with more prudent underwriting in higher-risk or complex projects.

- Cyber – soft/stable market across UK and US despite major cyber events across the year.

- Marine – soft/stable, with most areas of the market seeing rate decreases. However, some P&I clubs are imposing small increases on members, reflecting a market vulnerable to sudden shocks.

- Professional Liability – generally soft/softening but with some pockets at risk of firming, particularly around legal liabilities.

This downward pressure on rates is good news for customers, but it presents a complex challenge for carriers. As rates are driven down, it can be easy for underwriters to make short-term cover decisions to protect profitability, possibly defaulting to a ‘computer says no’ approach, putting their customer and broker relationships at risk.

Panellists in November’s episode of our INFUSE webinar tackled these concerns, exploring how underwriters can balance customer-centricity and underwriting profitability. Hayley Robinson, a non-executive director and advisor to the commercial and specialty markets, addressed potential tensions but advocated for flexibility in dealing with risk appetite:

“You can have something that is on the edge of appetite, but through risk management, through terms and conditions, through price, you can pull it back into a reasonable appetite.”

Our panellists argued for the power of transparency in communication to explain why some risks are no longer acceptable, and the importance of thinking creatively about ways they can support the broker and client by taking a more holistic risk management approach to assessing each risk.

“If, as underwriters, we’re transparent in how we come up with our pricing, what we can write and what we cannot write, I feel like we can actually communicate that to our clients. That will foster a little bit of respect and comfort, and they’re more likely to stay with us even if we stay down to those kinds of risks.”

– Russell Brown, Principal, Vessel Pollution, Falvey Insurance Group.

Ultimately, these downward pressures will pose challenges for underwriters, but Lloyd’s CEO, Patrick Tiernan calls for the market to “be bold” in tackling them. At the Insurance Insider ‘London Market Conference’ in Nov 2025, he emphasised that sustained profitability will depend on its ability to combine underwriting discipline with innovation as the cycle softens, and rallied with a call to “progress through boldness” as we move through the new year.

TREND 2:

Insurance operating models are being rebuilt

Insurance distribution is becoming more complex as carriers look to scale without slowing down. Many are diversifying distribution channels and adopting new operating models to better meet customer expectations, deploy capacity intelligently and drive profitable growth. The traditional linear flow of risk is giving way to a more sophisticated, multi-channel approach that blends direct placement, broker facilitisation and delegated authority arrangements.

“The role of carriers, the role of brokers, the role of the market as an infrastructure is changing, and changing fast”

– Luis Prato, President UK & MENA, Liberty Specialty Markets.

Broker facilitisation has emerged as a particularly significant trend in the London market over the past year. These arrangements, where capacity is pre-agreed across a defined range of business, represent more than just a tactical response to market conditions. They signal a medium-term strategic shift in how syndicated risk underwriting operates. By establishing pre-agreed terms and capacity allocations, facilities enable risks to be placed with far greater speed and certainty. At a recent Camelot executive breakfast roundtable, sponsored by Send, one participant disclosed that in some cases, over 90% of capacity is now secured through these facility arrangements before a risk even reaches the traditional lead market.

Simultaneously, the growth of managing general agents/underwriters (MGAs/MGUs) has accelerated. Spokesperson for Altamont Capital Partners, Joe Zuk, describes the MGA market as a “cornerstone of the global insurance ecosystem”, representing nearly $100bn in premium volume. During the Monte Carlo RVS in September 2025, Greg Carter, managing director of analytics, Europe, Middle East and Africa and Asia Pacific at AM Best, spoke at an event, reaffirming, “Something that we’ve seen in recent years is the growth of MGAs. They are very much at the forefront of innovation in terms of distribution and product design.”

Insurers are increasingly partnering with or establishing their own MGAs/MGUs to access specific market segments, diversify their distribution footprint, and experiment with new product offerings without disrupting core operations.

As a result, many carriers now operate truly multi-channel distribution models, at the same time managing direct relationships with major brokers, participating in facility arrangements, and delegating authority to select MGAs/MGUs. Bijal Patel, Co-founder at MGA, Aurora, observes:

“The data fragmentation and innovation speed challenges facing insurers today are driving new operating models within the algorithmic underwriting category, too. The algorithmic underwriting market is evolving rapidly, but there’s still a fundamental gap between ambition and execution. Traditional software platforms require years of implementation and deep technical expertise, while most MGAs and platforms lack the specialised know-how of algorithmic underwriting product design needed for complex lead underwriting.

A new category is emerging to address this gap: algorithmic underwriting delivered as a complete service. This hybrid model combines AI-driven automation with embedded underwriting and actuarial expertise, wrapped in a delegated authority framework that eliminates implementation barriers. Insurers can access sophisticated automation immediately and compete with algorithmic precision without building capabilities internally. At Aurora, we’re seeing this shift first-hand as we pioneer this new operating model, and 2026 will be pivotal as the market learns from the first real-world implementations.”

However, none of these distribution strategies can function effectively without robust data standards. The ability to operate seamlessly across multiple channels depends entirely on trusted, standardised data flowing consistently between organisations. When brokers adopt common data formats, they can interact efficiently with multiple carriers and facility structures. When carriers build their systems around standardised data schemas, they can process submissions algorithmically, generate portfolio insights in real-time, and make faster, more confident underwriting decisions.

“As we move into 2026, the strength of the insurance ecosystem will come from collaboration with underwriters, brokers, MGAs, and technology partners working more closely together than ever. It’s important to remove friction in how we share data and operate together, enabling underwriters to focus on making the right decisions for clients in an increasingly complex world.”

– Richard Morris, Executive Partner, Vega IT.

Poor or fragmented data remains a significant barrier to progress. Without standardisation, each new distribution partnership requires bespoke integration work, slowing innovation and limiting scalability. The ability to handle simple, repeatable risks digitally – while maintaining a high-touch approach for complex exposures – depends on systems that can use and share data seamlessly.

TREND 3:

Fragmentation defines the global risk landscape

One of the more concerning macro trends to emerge is the increasing fragmentation of society along social, political and economic lines. Global conflict and eruptions of political violence have become an ever-present feature of news bulletins, and international trade continues to be disrupted by supply chain issues, tariffs, and changing political alliances.

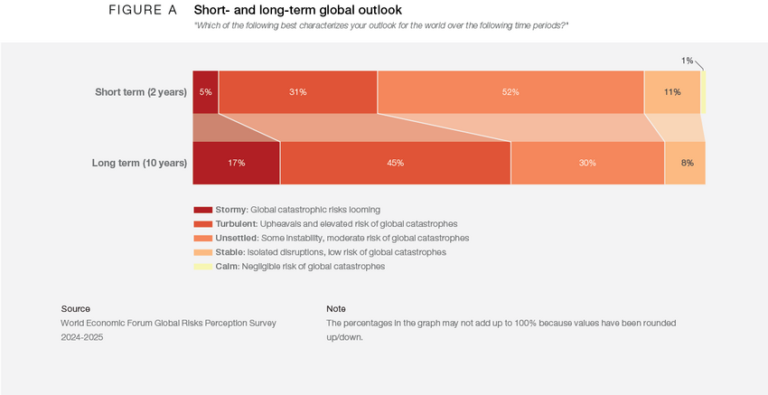

In September, the World Economic Forum (WEF) published its Chief Economists’ Outlook report, which found that 82% of chief economists surveyed expect fragmentation to intensify in 2026, with trade tensions at the heart. Another WEF paper, published earlier in the year, ranked ‘misinformation/disinformation’, ‘state-based armed conflict’, ‘societal polarisation’ and ‘geo-economic confrontation’ among the ten most severe global risks over the next two years. The report also shows that the majority of respondents expect the global market outlook to be “stormy” and “turbulent” over the next 10 years.

An increasingly fragmented global landscape presents real challenges for carriers. New and evolving sanctions and tariff activity present significant barriers to cross-border activities, making it more difficult for carriers to spread risk and diversify their portfolios globally. Although the Swiss Re Institute reported that US tariffs have had a “non-negligible but limited negative” impact on global P&C premium growth, the long-term effects of these trade tensions are likely to be more profound.

“We expect tariffs to slow global GDP growth, and consequently weigh on insurance demand. In the long term, US tariff policy is another move towards more market fragmentation, which would reduce the affordability and availability of insurance, and so diminish global risk resilience.”

– Jérôme Haegeli, Swiss Re’s Group Chief Economist

At the same time, the distinction between insurable volatility and deeper uncertainty is becoming more pronounced. As Dean LaPierre, Chief Underwriting Officer at CrossCover Insurance Services, LLC, observes:

“Insurance is a product that responds well to volatility. Where it shines is in acting as a shock absorber to rare, but knowable events. Insurers will gladly accept volatility (for a price) and that price is a function of economic supply and demand. Things get more turbulent when talking about uncertainty. The lack of clear economic policy (tariffs), geo-political tensions (conflicts), and social disruptions stemming from rapid advancements in technology (generative AI) all create an uncertainty about the future – something that can threaten capital markets and insurers performance in effectively transferring risk. We are living in an uncertain time.”

Another critical challenge presented by geo-economic fragmentation is the barriers it creates for true innovation. Global challenges such as climate change and cybercrime require global solutions, but the increasing divisions between countries and the realignment of some trading relationships make collaboration increasingly difficult. Internally, these divisions may also become apparent across international carriers, leading to siloes, fragmentated underwriting approaches to underwriting and technology implementations.

But all this turmoil creates opportunities for insurers as buyers have an increased need for certainty and protection in an increasingly uncertain world. A 2025 report from the Geneva Association outlines some of these opportunities such as growing demand for products like Political Risk insurance, Trade Credit, Marine and Supply Chain insurance. A push for energy independence could also create opportunities for more localised Construction and Engineering projects, particularly in the renewables space. Finally, heightened regulatory scrutiny, compliance breaches, and reputational risks in fragmented markets increase the need for D&O insurance to protect executives and board members.

As Brad Irick, Managing Executive Officer and Co-Head of International, Tokio Marine writes in the report:

“In times of uncertainty, especially amid geo-economic fragmentation, insurance can demonstrate its value by providing stability and financial protection. As businesses and individuals navigate increasingly unpredictable political and economic landscapes, the role of our industry as a shock absorber is continually gaining in importance.”

TREND 4:

Operational fundamentals are no longer optional

Speed, connectivity and accuracy are non-negotiable for underwriters in 2026. We’re operating in a market that expects instant responses, flawless data exchanges and greater accountability for decision quality. Brokers have accelerated their own digital transformation, pushing for faster quote-turnaround and tighter integration between systems. At the same time, softening market conditions are forcing every insurer to demonstrate underwriting discipline while maintaining performance. With these factors in mind, carriers can no longer operate efficiently (or profitably) using patchwork systems or manual workarounds.

This year, our focus must turn to strengthening the core systems that underpin the underwriting process. While recent years have been defined by experimentation, playing around the edges of AI, and trialling new and innovative point solutions to accelerate underwriting, many carriers now see that meaningful progress depends on their underlying infrastructure. Without consistent data standards, robust processes and clear rules, even the most sophisticated technology will struggle to deliver value. The industry’s drive to become truly connected will depend on how effectively insurers can modernise and align their foundational systems.

The importance of a strong digital core is increasingly recognised across the market. As Matt Carter, Strategy & Consulting at Accenture, explains:

“Unlocking underwriting modernisation demands a strong digital core, where robust technology, data-driven insights, and external partnerships are all digitally connected. By investing in foundational systems and organising data in a consistent and consumable manner, risks can be proactively managed by leveraging AI, underwriters and brokers can become more empowered, and insurance businesses can adapt with improved agility. Transforming challenges into opportunities requires businesses to be architected the right way, in 2026 all the tools are readily available to make this a reality.”

The challenge is that many carriers are still balancing decades of legacy technology with new digital demands. Some are taking bold steps to ‘rip and replace’ ageing platforms, while others are introducing orchestration layers to connect disparate tools and data sources. Either way, the goal is the same: to create a unified, flexible foundation where data can flow freely, and underwriting decisions are informed by a single version of truth. By addressing the basics first, insurers can move from a process-driven mindset to a data-driven model, where speed does not compromise accuracy, and automation augments rather than replaces underwriting judgement.

As with many of the trends shaping underwriting in 2026, the key is data. Underwriters rely on data accuracy and integrity to identify patterns, refine pricing and respond to emerging risks. Yet too often, inconsistent formats, incomplete datasets or incompatible systems slow down progress. In 2026, more carriers are expected to invest time and resources in establishing shared data standards, cleaning up legacy information, and deploying governance frameworks that ensure quality at every stage. This isn’t just about compliance or integration, it’s about unlocking the full potential of AI. Even the most sophisticated tools are only as good as the data they learn from, and underwriters who can master the interplay between quality data and intelligent analytics will quickly outpace those who rely on legacy methods.

Expense pressure is another powerful motivator. As operational costs climb and competition intensifies, insurers need to operate in leaner, more efficient ways. That means standardising processes where possible, automating routine tasks, and freeing underwriters to focus on areas where the human art of underwriting adds greatest value – assessing complex risks, relationship building, and strategic decision-making. The winners in 2026 will be those who pair advanced technology with operational discipline: fast, accurate and connected, but grounded in strong data and process fundamentals.

The road to underwriting transformation starts with the foundations. Carriers that invest now in getting the basics right are setting themselves up not just for efficiency, but for agility in a rapidly changing market. Those that don’t risk being left behind, overtaken by competitors that built their digital evolution on solid ground.

TREND 5:

Connectivity between the broker and carrier becomes indispensable

The connections between broker and carrier, particularly at ingestion, must ramp up carriers’ priority list in 2026. In the softer market, successful underwriters will compete on how quickly and smoothly they can turn broker submissions into usable data for fast, accurate quotes. With efficiency and data quality delivering the competitive edge, relying on the traditional manual review of submissions, rekeying of data, and bordereaux just won’t cut it any more.

Emails, spreadsheets and PDFs add cost, increase the risk of error and slow everything down, right at a time when brokers are using better technology and data to target their core markets. We’re seeing carriers investing heavily in technology to improve data ingestion, visibility and analysis, but without a robust ingestion process to handle unstructured broker data at scale, none of those investments will pay off in terms of smarter risk decisions, pricing or portfolio management.

As Kate Enright, Head of Data at Chaucer, explains the importance of broker–carrier connectivity in a softening market:

“In 2026, as we move into a softening market, broker–carrier connectivity is foundational to sustained performance. For brokers, placing submissions through automated workflows delivers benefits such as improved placement efficiency, pricing optimisation, and more effective cross-class portfolio management. For underwriters, higher-quality submission data reduces time to quote and enables standardised decision-making, automated market appetite alignment, and portfolio optimisation. Working together can support improved operational efficiency, reduced portfolio volatility and deliver a better customer outcome.”

It’s not just the market cycle driving this trend, however. Brokers have been rapidly maturing in their adoption of technology, and in recent years have rolled out platforms that can tie together CRM, placement tools, workflows and analytics, all built for API connections and smooth data flows instead of the relentless flow of emails.

They’re using AI and automation to augment and tidy up submission data upfront, so they can compare markets, track service levels and see how well carriers actually use what they send.

Insurers that can’t grab that structured data smoothly end up being viewed as an unnecessary hurdle, resulting in brokers sending more of their business to the carriers that reply quickly, reliably and digitally. Strong ingestion processes are increasingly a must-have for getting on panels and winning more share of business.

But aside from the obvious need for better connectivity and submission processes, data quality and standards are vital. It’s all very well speeding up ingestion, but if the data being ingested is of poor quality or submitted in different formats by each broker, carriers face further challenges in using this data efficiently. The problem, however, goes beyond submissions alone. Many Market Reform Contracts (MRCs) remain on paper, while Core Data Records (CDRs) and Schedules of Values (SoVs) also present ingestion challenges. Although these issues have been largely solved in some areas, market-wide adoption remains inconsistent.

Highlighting the role of AI, standards and collaboration in addressing these challenges, Hélène Stanway, Independent Advisor to the London Market, notes:

“Broker-carrier connectivity in 2026 will be underpinned by investment in the use of AI for data cleansing and analysis, complemented by the adoption of data standards. This combination, alongside broker-carrier collaboration, will enable the desired straight-through processing and smarter and faster underwriting decisions.”

This shift will inevitably change how underwriters work in 2026. With better ingestion platforms pulling in, augmenting and cleansing data at submission, they will spend less time manually keying and rekeying data and chasing missing information, and more time using their expertise on complex risks, unusual cases and bigger portfolio choices. Solid ingestion hands them cleaner, fuller data to run predictive models, set appetites and triage risks efficiently.

To this end, Jakub Śliwiński, Head of Underwriting at Sollers, cites the rise of underwriting technology as a means to solve this continuing problem. He writes:

“Underwriting technology is gaining yet more momentum, particularly in the UK, Canada, the Nordics and Australia, with an increasing number of P&C carriers implementing underwriting workbench and automation tools. We’ve successfully completed four underwriting workbench implementations in 2025 across the Lloyd’s and London markets in partnership with Send. This technology fundamentally supports the ingestion processes, replacing fragmented, email-heavy workflows and manual processes that previously posed operational risks.”

Addressing these connectivity challenges will also change the nature of the relationship between brokers and underwriters. Traditionally a transactional relationship, with the right tools and investment, this partnership will become more collaborative and strategic, with each party gaining new insights about the other, as well as a better understanding of their individual appetites and clients.

TREND 6:

The underwriting talent pipeline is being reshaped

Over the past decade, the industry has worked hard to make insurance more attractive to a new generation of professionals. In the US, organisations such as WSIA, The Institutes, the Big “I”, and RIMS have invested in emerging-talent programmes, university partnerships, and modern outreach to ensure insurance remains a compelling career choice for the next generation.

In the UK, the Chartered Insurance Institute (CII), London Market Group (LMG), and Lloyd’s Market Association (LMA) have all launched dedicated initiatives to attract new insurance talent in recent years, focusing on outreach to schools and colleges, trainee programmes, and even TikTok campaigns to reach new audiences.

These initiatives are particularly timely. Analysts suggest that 400,000 insurance workers in the US will retire from the industry by 2026, and the London Market faces a comparable demographic challenge. According to Sheila Cameron, chief executive of the LMA, the proportion of the workforce aged over 50 has risen from 17% a decade ago to 25% today and is expected to reach between 35% to 40% by 2035.

However, the large-scale exodus of talent from our workforce, combined with a push for brand-new insurance professionals, presents a unique challenge. How can we ensure that the decades of knowledge accumulated by departing experts can be transferred to a new generation?

Here, AI presents both a threat but also an opportunity.

On one hand, sophisticated tools, including Agentic AI, are increasingly being used to take on the sort of repetitive, manual work that would once have gone to junior staff, such as underwriting assistants. Those tasks have traditionally been the first rung on the career ladder, giving new joiners a way to learn the foundations of insurance whilst working alongside more experienced colleagues. If too much of that work is automated away, the initial step into an underwriting career could become harder to reach, shrinking the pool of new talent entering the market just as it is needed most.

On the other hand, AI can be part of the solution if it is used to support rather than replace the development of new professionals. The same tools that automate routine tasks can instead be designed to capture and codify the thought and decision-making processes of senior underwriters, who often work based on finely honed intuition and ‘gut feel’ rather than tangible underwriting manuals. Once captured, these processes can be played back to trainees via guided workflows, coaching prompts or simulated scenarios, allowing them to experience more complex risks, earlier in their careers.

As the balance between automation and human development becomes increasingly critical, Suzanne Bray, Head of Talent & Growth at Convex, highlights the risk of inaction:

“Underwriting judgement cannot be automated – but it can be lost. As AI reshapes early-career roles and senior expertise exits the market, the future of underwriting will depend not just on the talent we attract, but on how intentionally we develop it. Without clear pathways, mentorship and knowledge transfer, we risk hollowing out the pipeline – particularly for women and emerging leaders. This is the moment to redesign underwriting careers, not simply replace roles.”

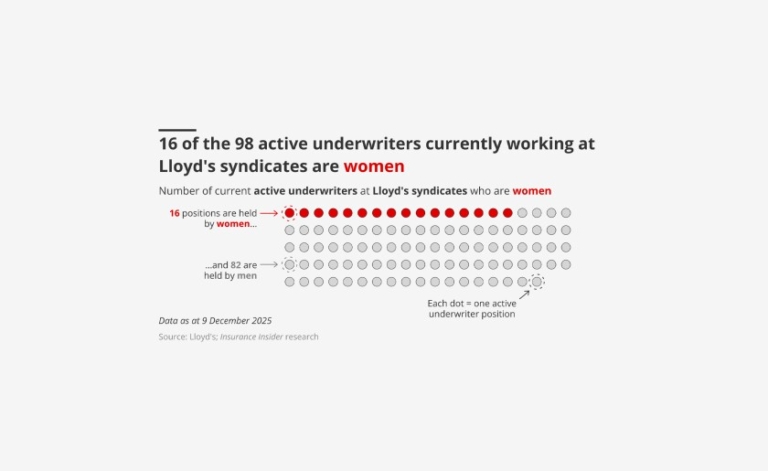

Another equally concerning trend is a clear backwards step in the progression of female underwriters.

Graph reproduced with permission of Insurance Insider.

New research from the Lloyd’s Market Association (LMA) in October paints a stark picture of the gender divide in underwriting. The 2025 Lloyd’s Market Policies and Practices survey revealed that of over 7,500 people in underwriting, 38% are women, and in CUO (or equivalent) roles, just 18% are female. More worrying for the future of the market is that only 15% of women are expected to be ready to take on leadership roles in the next two years (three percentage points less than last year), and just 25% in the next 3-5 years (down four percentage points from last year).

In a statement on the results of the survey, the LMA’s Cameron said:

“The themes from the survey respondents show that the decline in our female underwriting pipeline reflects intertwined structural and cultural barriers.”

Cameron also suggested that many firms had been focused on controlling the hiring of diverse talent, but such controls weren’t in place for promotion.

As the industry pushes to attract the next generation, a critical question emerges for 2026 – are we doing enough to develop, retain and prepare the talent we already have?

TREND 7:

Reinsurance enters its next era

The reinsurance landscape is entering what Willis Re has badged ‘Reinsurance Market 2.0,’ a fundamental shift in how capacity is sourced, deployed, and managed. This evolution is influenced by three forces: data-driven enhancements in modelling and analytics, widespread technology adoption across the entire risk chain, and diversification of capital sources. This shift is further supported and enabled by the changes in distribution strategies across the market, increased delegated authority arrangements and broker facilitisation (see Trend 2).

“Reinsurance is changing its spots. Whether aggressively or reluctantly, carriers, brokers and capital providers have begun to embrace the current, unprecedented wave of technological change. The ongoing upgrade to Reinsurance Market 2.0 is reflected in reinsurance products, pricing, risk management and even regulation.”

– Willis Re.

Data lies at the heart of this shift with reinsurers no longer competing solely on price or appetite, but on their ability to harness granular, real-time information to make faster, more accurate risk decisions. Cloud-native modelling platforms, AI-enhanced analytics, and multi-model approaches are enabling portfolio optimisation and scenario analysis that would have been impossible just a few years ago. This data sophistication is attracting a wider range of investors to reinsurance risk. Once considered opaque and highly risky, the clarity and transparency of modern risk transfer mechanisms help to lower many of the traditional barriers to entry.

Accumulation control is increasingly critical in this environment. As Marcus Winter, President and CEO of Munich Re – North America, explains in AM Best’s report:

“Accumulation control is critical for reinsurance companies to maintain a stable balance sheet and to preserve the overall health of the insurance industry. Our approaches for accumulation control are now more sophisticated than ever. Thanks to new, proprietary modeling capabilities and data insights, we can uncover more granular data for perils such as wildfire or computer viruses.”

Transformative changes in broker-led platforms and delegated authority models are pivotal to supporting this new era of reinsurance, strengthening the ecosystem and creating a strong chain that connects frontline underwriting to global capital. Facilities now incorporate automated bordereaux, real-time exposure tracking and AI-driven risk scoring, allowing reinsurers to monitor and adjust capacity dynamically without the friction of annual renewals. This technology not only reduces administrative drag but also enables complex multi-layered structures, seamlessly blending treaty, facultative, collateralised reinsurance and even parametric triggers that align precisely with portfolio needs, smoothing volatility while delivering optimal capital efficiency.

Many believe 2026 will be the year Reinsurance 2.0 gains real traction, as market pressures and maturing technology finally turn data-driven reinsurance into everyday practice.

London market standards, like unified data formats and better broker connectivity, will smooth data flows throughout the chain, from delegated schemes through to reinsurers and investors, swapping clunky spreadsheets for automated updates that let capacity flex with real portfolio needs instead of fixed yearly deals. Reinsurance capital continued its recovery through H1 2025, approaching pre-2022 peak levels, according to Gallagher Re. However, softening rates across the market are forcing carriers to quantify every reinsurance dollar through clear metrics on recoveries and overall returns, while reinsurers focus on portfolios with reliable data to cut pricing guesswork.

Evolving regulatory frameworks like Solvency II favour data-transparent cedants through more streamlined reporting and risk calibration. At the same time, brokers are rolling out ready-made facilities for MGAs that combine traditional reinsurance, investor capital and parametric cover, supported by shared analytics to attract capital to strong-performing books.

So, what might be the secret to reinsurance success in 2026? According to Christopher Gray, Divisional Director, Reinsurance at Westfield Specialty, the buzzword for next year is ‘creativity’. He states:

“Reinsurers will need to be smart thinkers to succeed in 2026. To succeed in this complex and challenging environment, reinsurance needs to prove its value. Clients will retain more risk if they don’t see a value in what they are buying. Let’s work hard to deliver that value as we head towards a challenging but exciting year ahead.”

Reinsurance 2.0 presents both opportunity and obligation. The opportunity lies in accessing deeper pools of capital, deploying capacity more efficiently, and building portfolios with unprecedented precision. The obligation is to develop the data literacy, technological capabilities, and operational frameworks to thrive in this new environment. Underwriters who can successfully navigate delegated arrangements, leverage advanced analytics, and work seamlessly within broker-facilitated ecosystems will gain significant competitive advantages.

TREND 8:

AI moves from hype to underwriting impact

We referred to 2025 as the year “AI goes mainstream” across the industry, and in 2026, this goes one step further as AI agents join the underwriting workforce in increasing numbers, and generative AI is adopted much more robustly across the market.

Towards the end of 2025, the term ‘agentic AI’ was almost inescapable, but this isn’t just another technology buzzword – these agents have the potential to transform underwriting, if they are deployed strategically.

AI agents are expected to impact the full lifecycle of underwriting from intelligent intake, to risk decisions and ops performance. But what are some of the real-life use cases for agentic AI, and how do we expect it to be deployed in 2026?

- Hyper-personalisation – AI agents can continuously learn and infer trends from the data they ingest on customer profiles and behaviour patterns. This rapid analysis can be used to continuously tailor products and pricing in real-time, delivering a more relevant, valuable product to customers.

- Smarter submission – a current popular use for agents is for submission triage at scale. AI can scan entire submissions for key details, flagging any vital information for underwriters to review. Underwriters can therefore save time scouring submissions, relying on their agents to feed them only the most important information and best quotes. As insurers invest in better technology foundations and the structures to facilitate agents, we only see usage increasing.

- Adding context to risk – underwriters have to Google a lot of information, scouring public records, databases and social media to learn more about the risks they’re presented with. Not only is this inefficient, it could be ineffective, and as always, there’s a risk of human error in transferring this information between systems. AI agents can take this onerous task away from underwriters, allowing them to concentrate on the key risk information.

- Training day – agents could also be used more widely in 2026 as training tools, generating practice cases, grading underwriting decisions against appetite and underwriting guidelines, while detailing the impact of individual decisions on portfolios. As the industry continues to grapple with the problem of knowledge transfer from retiring underwriters, AI agents could be a vital tool for knowledge capture and transference.

The importance of deploying agentic AI in live underwriting environments, rather than treating it as a theoretical exercise, is already being recognised by leading carriers. As Amy Nelsen, Head of Underwriting Operations, US Middle Market at Zurich North America, explains:

“Agentic AI creates real underwriting impact when it is used, not when it is over-engineered. Progress comes from putting these systems into live workflows, learning from outcomes, and improving them over time. When combined with strong human oversight, agentic AI becomes a powerful partner, continuously refining decisions and enhancing judgment through everyday use.”

With increased pressure on carriers to maintain profitability, any investment in technology needs to demonstrate strong return on investment (ROI) and quickly. The good news is that these AI agents are already delivering impressive ROI for carriers that have carefully considered where and how they can integrate them. Experts suggest the underwriting process could be reduced by up to 75%, output per underwriter could double, and underwriting expense ratios could be reduced to 20%.

This shift from experimentation to execution is being reflected across the wider insurtech market. As Freddie Scarratt, Global Deputy Head of InsurTech at Gallagher Re, notes:

“As highlighted in our Q3 2025 Global InsurTech Report, where 75% of funding targeted AI, the market has traded ‘future-gazing’ for pragmatism. The next phase isn’t about disruption, but deployment – leveraging these tools to operationalize data, strip out administrative friction, and deliver the granular underwriting precision required for 2026.”

When it comes to AI in 2026, it became clear to us at ITC Vegas that ‘how’ AI is deployed will be more important than ‘what’ tools and solutions are used.

Throughout our time at ITC Vegas in November, we consistently heard from actuaries, regulators and carriers that auditability of AI will be crucial in 2026. There will need to be clear guidelines for use, and transparency of how and where it is being deployed throughout insurance businesses. As one expert we spoke to put it: “AI that can’t be explained is AI that can’t be adopted”. Here, the EU’s upcoming ‘EU AI Act’ may help shape auditable, explainable AI use by implementing greater governance around its usage.

TREND 9:

Parametric solutions narrow the protection gap

Parametric insurance was on the agenda for the G20 at a Disaster Risk Reduction Working Group meeting in November 2025 in South Africa. In recognition of the key role parametric insurance could play in closing the growing global protection gap, leaders pushed for a scaling-up of parametric insurance, as well as risk pools and catastrophe bonds.

Climate change, geo-political instability (see Trend 3), and economic pressures are converging to create a significant global protection gap, which, according to the 2024 Swiss Re Resilience Index, could top $1.8 trillion.

Industry leaders are increasingly vocal about the scale of this challenge and the responsibility facing insurers. As Mark Cloutier, Chairman and CEO of Aspen, observes in AM Best’s report:

“I think about the subject of protection gaps. Just the sheer order of magnitude of some of those gaps is widening. We’re not, as an industry, doing a great job of answering the opportunity to deploy capital there and to serve one of our purposes of building resiliency and sustainability into economies.”

The need for innovation in parametric insurance is most acute in regions such as the Pacific and Africa, areas where insurance penetration is still significantly low, yet the economic impact of a major weather event is high. These policies are already proving valuable, particularly in remote farming communities, where one weather event could have a devastating impact on the policyholder’s livelihood. In late 2024, the Pacific Insurance and Climate Adaptation Programme (PICAP) rolled out 37 parametric products over eight countries, including Fiji, Papua New Guinea, Samoa, Solomon Islands, Vanuatu, Tonga, and Kiribati, with payouts triggered throughout 2025 for cyclones, excess rainfall, droughts and earthquakes.

We’re now seeing parametric products expanding into new, more complex business lines as the availability and accuracy of data improve and technology matures, allowing for more accurate predictions. For example, Ki Insurance can now track supply chains via GPS to trigger quick payouts on supply chain disruption while US-headquartered parametric specialist Parametrix swung into action with its Cloud outage cover when Amazon Web Services went down in October 2025, paying policyholders within two weeks of the incident.

As the market evolves, some warn that failing to innovate fast enough risks leaving insurers exposed to relevance gaps alongside protection gaps. As Rachel Turk, Chief of Market Performance at Lloyd’s, notes in AM Best’s report:

“There’s the protection gap, which is obviously the difference between the economic loss and the insured loss on nat cat really, but I think there’s then the underinsurance gap. I look at what risks companies have on their risk register, what they’ve got on their balance sheets and [believe] the biggest risks they’re worried about are not the ones that we’re insuring and offering insurance for. I do really worry, with the sort of lack of product innovation that we’re seeing, that we risk moving ourselves into irrelevance if we don’t start to address those big issues.”

Hybrid-parametric solutions are also gaining momentum in the market, combining fast parametric triggers for initial payout, then layering in an indemnity assessment to verify and adjust for actual losses incurred. At the Insurance Innovators Summit in October 2025, panellists shared how the insurance market was exploring new ways to package traditional cover for attritional losses with parametric triggers into one product.

Though not a new concept, parametric insurance is maturing rapidly thanks to advances in technology. AI and machine learning can quickly analyse vast datasets for precise, dynamic triggers, such as wind speeds or seismic data and satellite imagery, IoT sensors, and real-time APIs deliver hyper-local monitoring, enabling instant payouts without the need for adjusters.

For carriers, parametric solutions are a prime opportunity to gain a competitive edge through faster claims processes and reduced operational costs, as well as the chance to tap into hard-to-insure risks like climate events, cyber outages, and supply disruptions, where traditional indemnity falls short.

Parametric solutions also give the global insurance market an opportunity to close the protection gap, bringing protection to communities and customers underserved by traditional insurance arrangements.

TREND 10:

Regulation becomes a strategic pressure point

Regulatory changes across the insurance industry in 2026 will raise the bar for transparency, accountability and resilience in both the UK and US markets. For underwriters, these evolving frameworks don’t just bring additional compliance challenges; they will reshape how risk appetite, product value and operational oversight are managed.

In the UK, the Prudential Regulation Authority (PRA) has scheduled the next Dynamic General Insurance Stress Test for May 2026. This will test firms’ climate scenario capabilities, liquidity under stress, and exposure to inflation-linked claims costs. For underwriters, the outcomes of these tests will drive direct conversations with the PRA and boards about risk tolerance, reinsurance dependency, and pricing discipline. It will require underwriters to understand capital implications far more deeply and to justify underwriting decisions within the broader solvency picture.

The Financial Conduct Authority has already tightened its Fair Value assessments under the Consumer Duty rules, requiring insurers to demonstrate measurable outcomes for customers. While many commercial lines are currently exempt, the expectation of value-for-money is starting to permeate the entire market. Underwriters could therefore face greater data-driven scrutiny on how pricing and coverage align with client outcomes, not just loss ratios.

As governance and explainability move from regulatory expectation to operational necessity, insurers are increasingly being told to rethink how compliance is embedded into underwriting processes. As Carey Geaglone, Senior Principal at Datos Insights, explains:

“The 2026 regulatory landscape demands transparency and governance frameworks as core capabilities. Insurers who operationalize these requirements can turn a compliance exercise into a competitive advantage through explainable decisions and disciplined pricing. This will be critical as agents and insureds, not just regulators, require insights into how decisions are made.”

The EU AI Act, taking effect in August 2026, will also have ripple effects across the insurance market. Insurers that use AI to support underwriting or claims automation will need auditable documentation explaining how models work, how bias is tested, and how decisions can be challenged. Although the Act applies within the EU, many UK carriers with European exposure or cross-border data-sharing operations will need to comply. The challenge for underwriters is that automation and AI scoring tools may slow down while governance processes catch up. However, the long-term positive is that this pressure for ‘explainable AI’ could build stronger client trust and improve the quality of underwriting decisions thanks to richer data validation and greater model accountability.

In the US, the regulatory picture is more nuanced, marked by greater state-level divergence and regulatory activism. While federal climate disclosure rules have eased, the National Association of Insurance Commissioners (NAIC) and several states are pushing forward with their own requirements. NAIC’s 2025 framework has already recommended that large insurers disclose their exposure to physical and transition climate risks. For underwriters, this means growing pressure to integrate climate data, not as an annual reporting exercise, but as a core input to pricing, accumulation limits, and portfolio diversification strategy.

At the same time, state regulators are expanding their focus on AI governance. Underwriters using automated or predictive models must now be prepared to explain their outputs and defend the fairness of rating factors. Though this introduces additional workload and approval steps, it also encourages more disciplined, consistent practices, reducing inadvertent bias and improving risk transparency.

Overall, for underwriters in both the UK and US, the regulatory landscape in 2026 presents both challenge and opportunity. The challenges are clear: slower product cycles, increased documentation, and potential friction between innovation and compliance. Yet the upside is equally significant. Stricter oversight could professionalise underwriting further, forcing sharper alignment between pricing decisions, governance, and ethical standards.

Conclusion

Underwriting next year will be shaped by a combination of softer rates, global uncertainty and the rapid advancement of AI and data innovation as the market looks to the power of technology to confront these challenges head-on.

As the market continues to cycle, sustainable profitability will depend on how effectively carriers can turn data, technology and differentiated distribution into disciplined, portfolio level decision making. All of this will demand strong foundations: standardised data, intelligent ingestion, modern core systems and clear governance so AI-enabled underwriting is safe, scalable, auditable, and able to deliver return on investment much more quickly. Without these basic foundations, even the most sophisticated tools risk becoming isolated experiments rather than engines of performance.

Ultimately, the choices carriers make now on connectivity, capital, talent and technology will determine whether they simply cope with the changing market, or use it as an opportunity to make competitive leaps ahead.

As always, we continue to talk to our customers and market experts to ensure we’re ahead of the curve, finding and delivering solutions that help insurers, delegated authority and reinsurers to work smarter, faster and more connected – after all, tomorrow’s market demands it.

We’d love to hear your thoughts on how underwriting will continue to evolve in 2026 and beyond, so please share your thoughts with us at hello@send.technology.

- Trends

Related Resources

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026