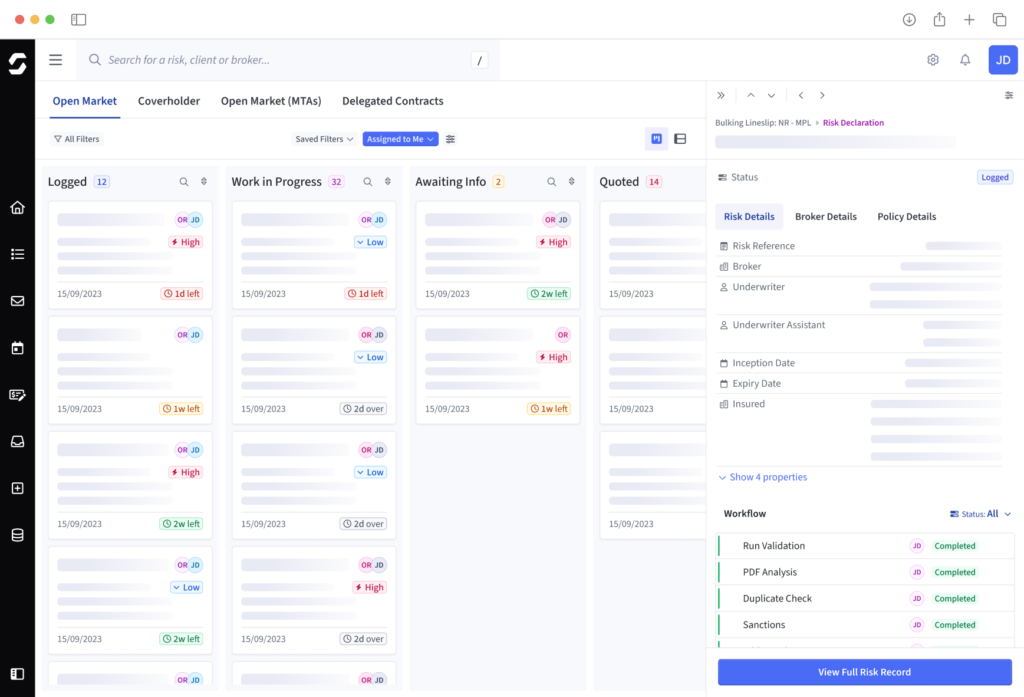

The platform for commercial and specialty insurers

Replace fragmented underwriting systems with a single platform that brings work, data, and decisions together.

Trusted platform for leading insurers

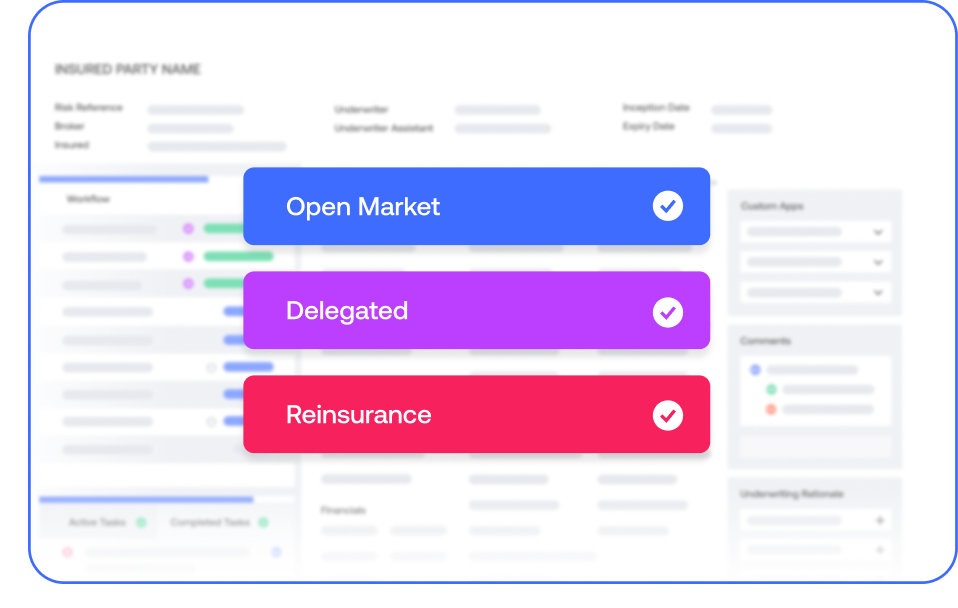

The only platform purpose-built to support multiple operating models.

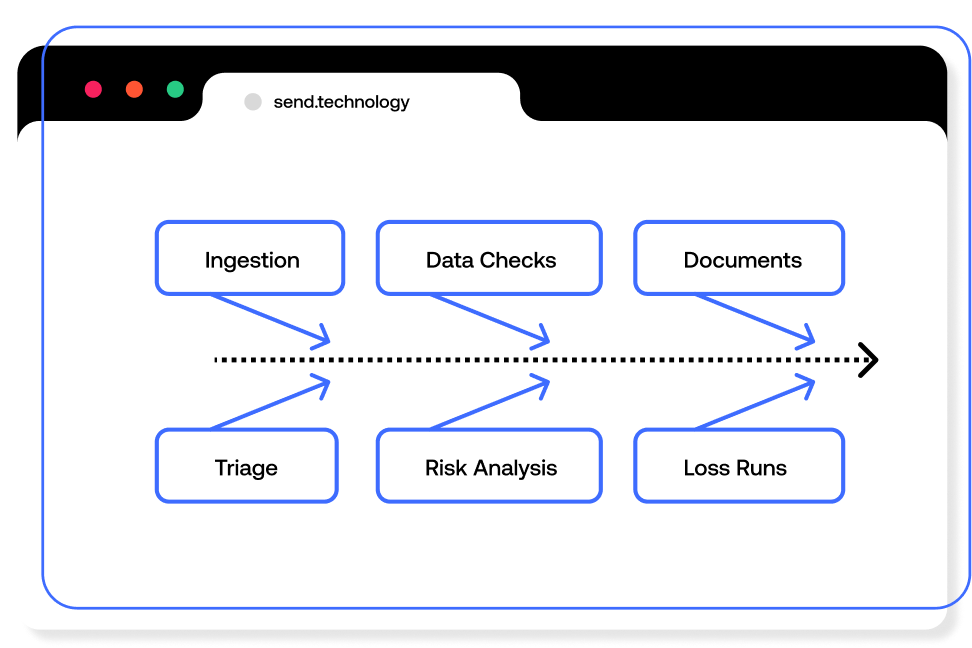

Orchestrated underwriting, end-to-end.

Run the full underwriting lifecycle in one connected platform. Send links data, systems, and workflows across every step, replacing silos with a single, controlled flow of work.

Teams get one view of work, fewer handoffs, and a workflow that stays controlled as complexity increases.

Built for complex markets.

Commercial and specialty insurance isn't simple, but it shouldn’t feel complicated. Risks are complex and markets are nuanced – your platform should reflect that.

Send is designed around real underwriting practices, supporting complex risks, varied market structures, and evolving operating models without adding friction.

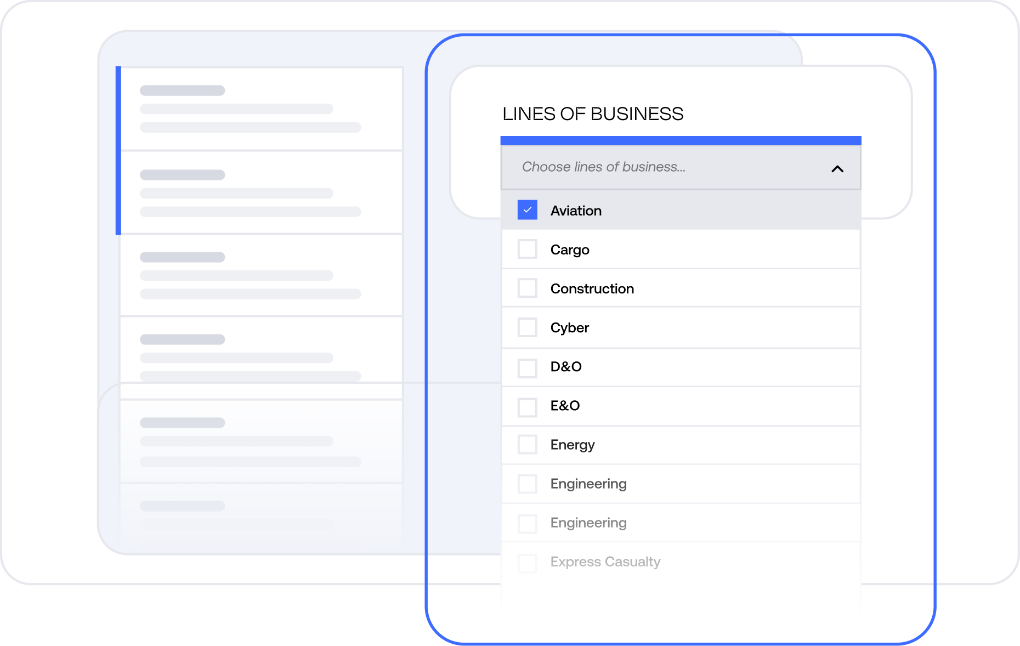

Insurance, by design.

Purpose-built for insurance teams, not adapted from generic software.

With insurance-specific data models, APIs, and proven use across 40+ lines of business, everything in Send reflects real roles, real pressures, and real decisions.

A platform that enables growth.

Markets evolve. Your platform can’t be the thing that slows you down.

Launch multiple products on a shared platform, with consistent data, governance, and workflows across direct and delegated underwriting – starting quickly and expanding as your business scales.

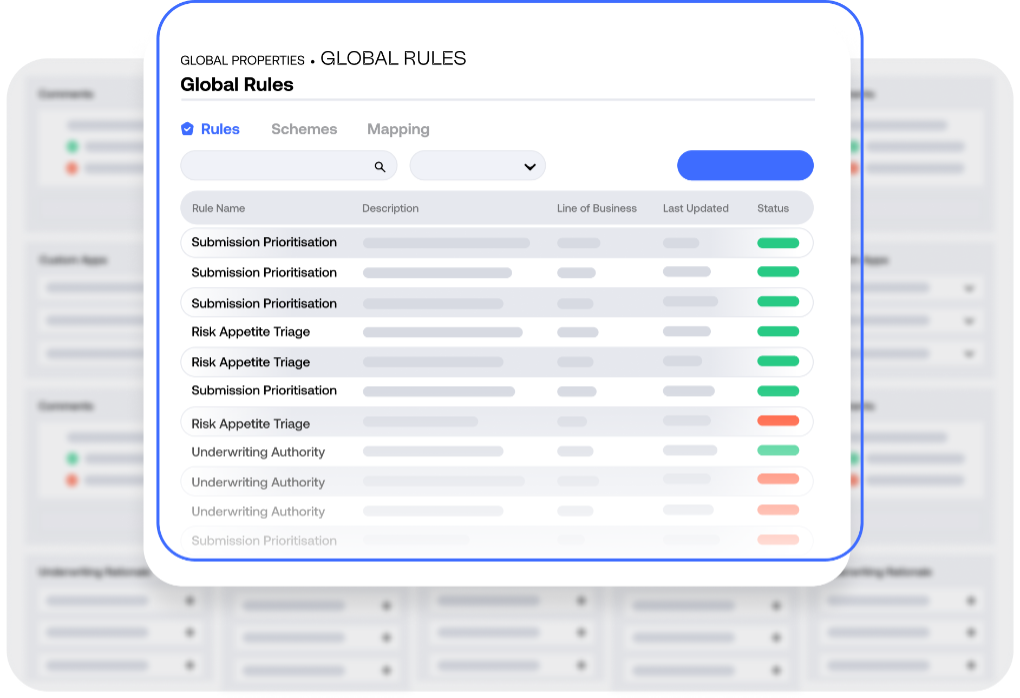

Compliance that scales.

Compliance becomes harder to manage as you grow.

Stay compliant across different markets and products with complete visibility. Send unifies your rules, controls, and audit trails in one platform, giving you confidence to scale fast.

Everything underwriting teams need,

working together

Core capabilities stay connected around the risk, from intake and pricing through to bind and beyond.

Send plugs into the tools you already use, with

APIs built to play nicely with your existing stack.

Pre-built workflows and data models for more than 40 lines of business

Secure with Send

We are fully secure & compliant, protecting every piece of your underwriting data.

Platform metrics

Products

Send for Direct Underwriting

Designed for insurers and MGAs writing open market business.

Send for Delegated Underwriting

Purpose-built to help insurers scale delegated business with confidence.

Send for Reinsurance Underwriting

The smarter way to structure and manage reinsurance programmes.

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026

Is your underwriting platform really delivering business value?

2026 – The year automated underwriting truly lands in London?

Send achieves ISO 42001 certification, setting the standard for controlled agentic AI in underwriting

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send