Underwriting that stays on track

Helping teams stay on top of every task, document, and underwriting decision throughout the risk lifecycle.

Managing activities across the insurance workflow requires a centralised, coordinated approach.

Activity Management gives teams the structure needed for key checks and approvals, while staying flexible enough to support complex cases.

By capturing underwriter rationale, organising supporting documents, and guiding task progression, teams stay aligned and keep moving underwriting work forward.

Too much underwriting work gets lost in emails, siloed teams, and offline tasks. Our platform brings every task, referral, document, and decision rationale together. Giving underwriters more time for the risks that matter.

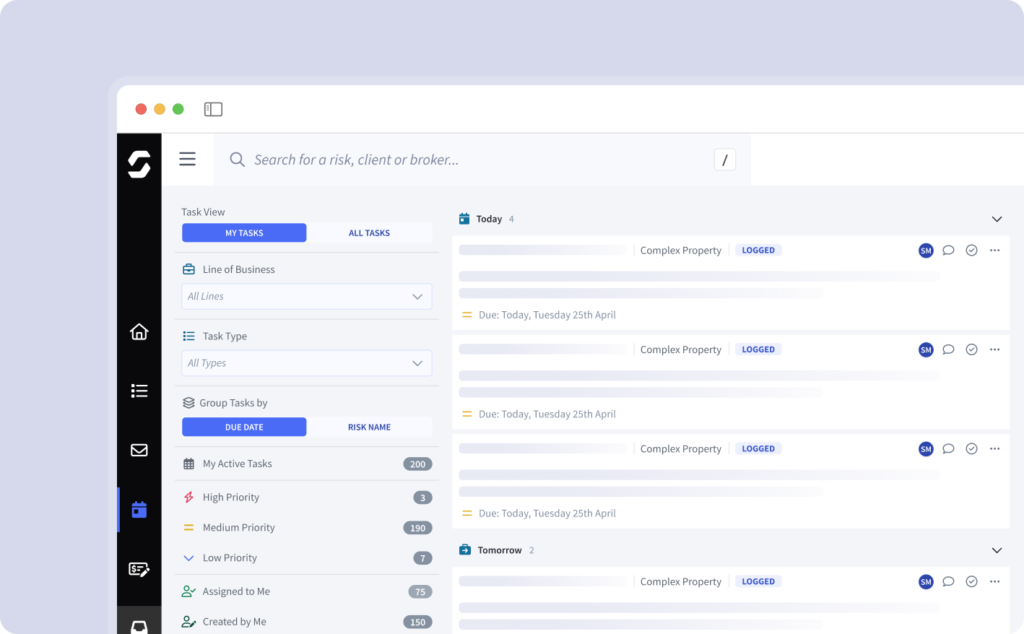

Task Management

Assign, track and monitor tasks with a clear view of progress – and see exactly what relates to each risk.

Keeping every activity moving through a consistent process with a view of what’s working well and where bottlenecks appear.

Referrals

Automate referral steps with workflows tailored to your rules – ensuring the right approvals happen at the right time.

Helping to reduce delays and maintaining full control and oversight.

Document Capture

Add and organise supporting documents in a structured, easy-to-find repository – all tied to the right record.

Giving your team quick access to the files that support each decision.

Underwriter Rationale

Capture insights and decisions in a central place using a clear, consistent structure – so context is never lost.

Surfacing meaningful decision rationale on the risks where it matters.

Underwriting that works together.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026