Automation to help you get more underwriting done

Configurable workflows and rules to route,

pause, and approve risks while keeping underwriting moving forward.

Automation only works when it's aligned with your underwriting processes.

Automation and Rules gives teams a controlled way to guide work through checks, approvals, and handoffs – all running in the background without disrupting underwriter focus.

With intelligent routing, authority controls, and integrated background checks, you reduce admin while keeping decisions consistent and auditable.

Our platform automates the busywork and

enforces rules in the background so underwriters remain focused on the risk.

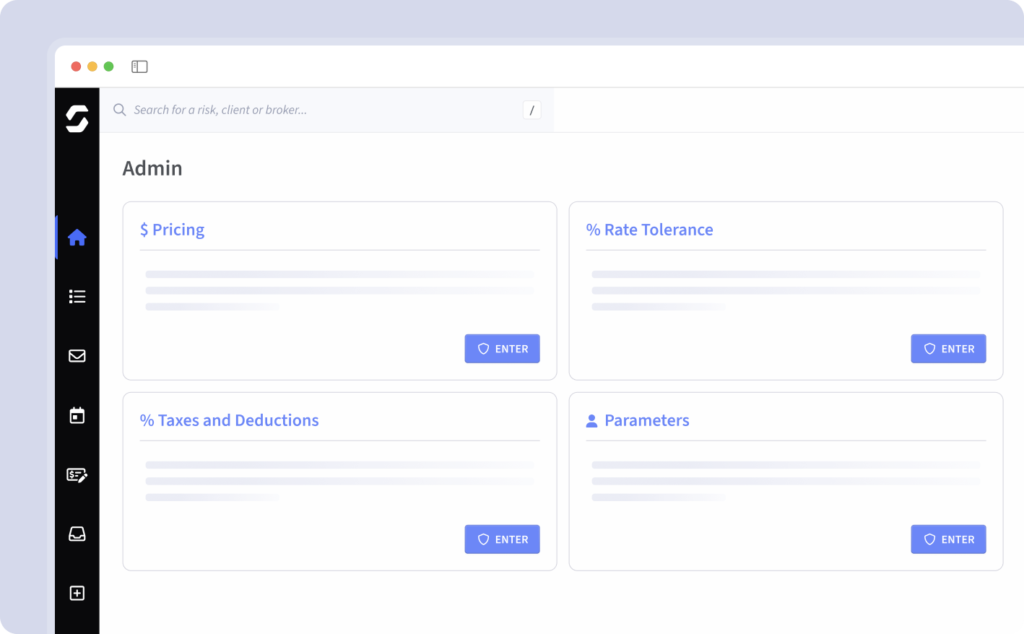

Workflow Automation

Route submissions, tasks, and approvals through configurable steps that match your operating model.

Keeping work flowing smoothly across the lifecycle with fewer delays and missed handoffs.

Rules Engine

Apply business rules for authority, compliance, escalation, and exceptions in a consistent way.

Reducing variation and rework while keeping control where it matters.

External Connectivity

Run integrated checks with sanctions, pricing engines, and document stores as part of the workflow.

Bring results into the process without pulling underwriters into separate tools.

Underwriting that works together.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026