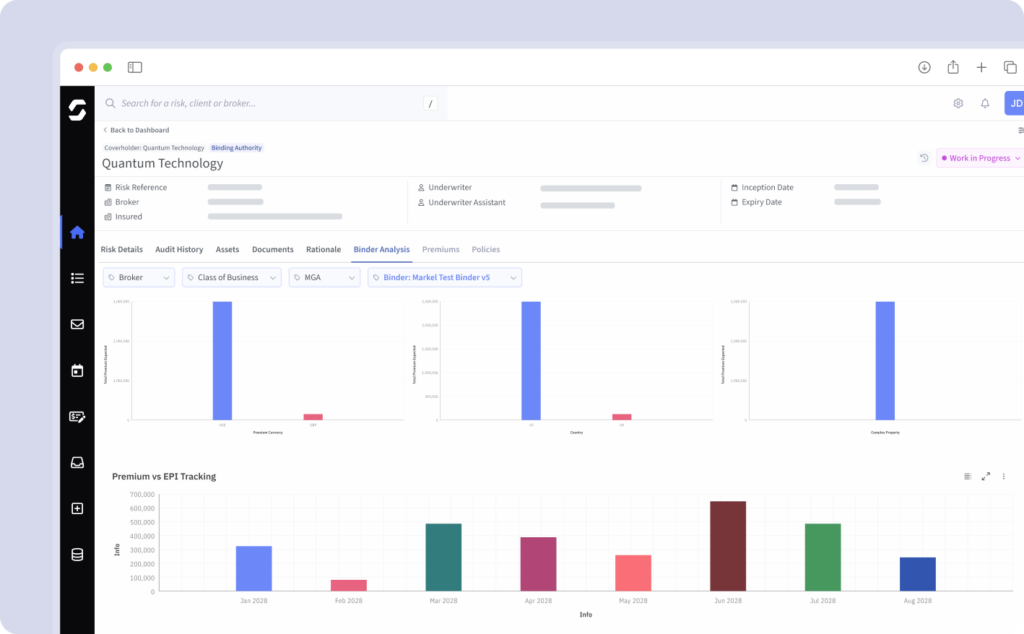

Simplify your binder and delegated contract management

Set up and manage binding authority agreements with structured approvals and lifecycle control.

Your delegated business can only scale if you have effective binder and delegated contract management.

Binder Management provides a centralised approval workflow aligned to your underwriting process, with the structure needed for complex arrangements.

Capture limits, rules, and hierarchies in a controlled way, so teams stay aligned and keep governance strong as your delegated business evolves.

Replace disconnected binding authority agreements with one controlled workflow that keeps every agreement current, consistent, and compliant.

Multi-layered contract structuring

Model contracts across policies, sections, and coverages to manage delegated complexity.

Capturing the detail that drives accurate validation and reporting.

Validation Rules and Limits

Contract rules and limits can be defined with clear parameters to support consistent validation.

Giving teams confidence that business written stays within agreed terms.

Contract due diligence

Configurable approvals match your internal review process and governance requirements.

Keeping contract setup consistent while supporting different operating models.

Contract lifecycle control

MTAs, renewals, and lapse processes are managed as part of a controlled contract lifecycle.

Tracking changes over time without losing auditability or control.

Underwriting that works together.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026