From messy bordereaux to trusted, usable data

Ingest bordereaux data quickly and accurately, with trusted data to make more confident portfolio decisions.

Turn messy bordereaux submissions into clean, validated, and ready to use data – quickly and accurately.

Bordereaux Ingestion brings in your data with automatic validation against contracted rules, including complex sub-coverage structures.

By converting ingested data into standard risks and policies, you bring delegated business into the same view as direct business – improving oversight and insight.

Delegated visibility is limited or arrives too late if bordereaux data is hard to standardise.

Our platform validates and structures bordereaux data quickly, so your team doesn’t waste time manually checking data.

Reporting schedules

Create schedules for bordereaux submissions and track what’s expected and what’s missing.

Keeping oversight clear across MGAs and coverholders.

Sections and sub-coverages

Map incoming records to the correct contract sections, products, and sub-coverages.

Supporting real-world delegated complexity without custom workarounds.

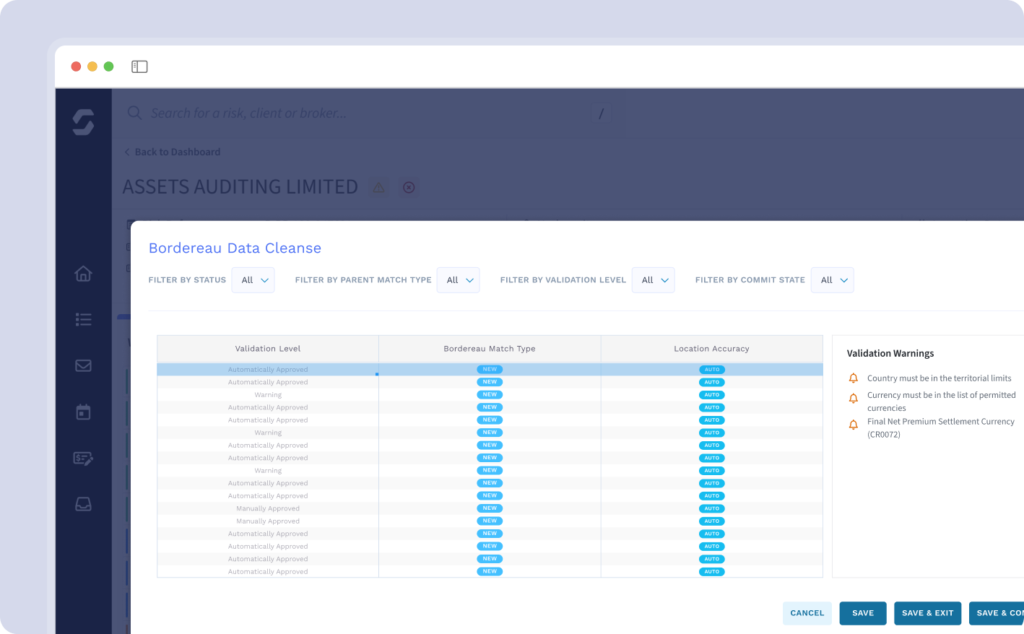

Interactive validation

Validate incoming data against binder rules and correct issues before processing.

Preventing invalid records from flowing downstream.

Exceptions handling

Capture pre-agreed exceptions to contract terms and apply them automatically.

Avoiding manual tracking that slows down imports.

Structured policy generation

Convert ingested data into standardised risks and policies for reporting and analysis.

Improving visibility across the whole portfolio and delegated partner performance.

Underwriting that works together.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026