Focus on the data

that matters

Risk and operational insights to understand performance,

spot friction, and underwrite with confidence.

Underwriting data is only useful when it’s easily accessible and tied to real decisions.

Data and Insights uses underwriting data to support risk-level decisions and cross-portfolio reporting.

With visualised metrics, workflow reporting, and operational MI, teams can identify what’s within appetite, challenge experience-based decisions, and see where process bottlenecks are forming.

Surface key data from underwriting activity so teams can act faster, see what’s working, and improve performance over time.

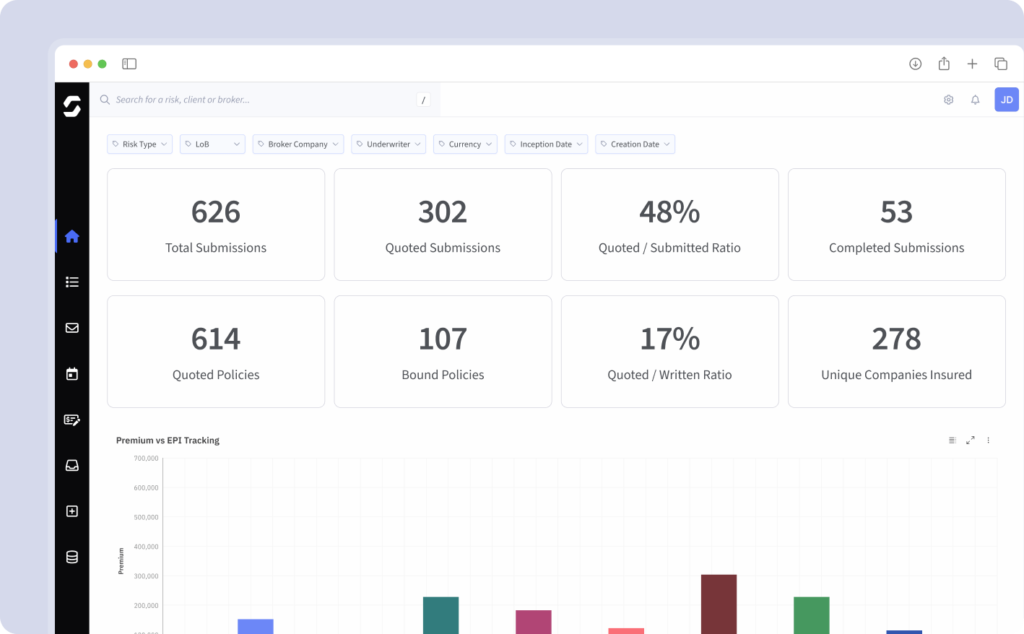

Team dashboards

Dashboards for a real-time view of your underwriting operations. Specific to teams or operating roles, focused on the risks they need to manage.

Helping teams stay on top of what matters without noise.

Real-time tracking

Track risks through the underwriting process in real time to support prioritisation and resource allocation.

Making it easier to manage workload and respond faster.

Custom views

Switch between Kanban and list views for a clear, comprehensive view of risks in the system.

Improving visibility for stronger operational and underwriting performance with management information you can trust.

Underwriting that works together.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026