Manage post-bind processes and connect to downstream systems – without rekeying data

Maintain underwriting momentum with post-bind workflows that keep policies moving and connected to downstream processing.

Turn bound decisions into clean outputs automatically so policies are issued faster and teams avoid backlogs.

This capability helps teams move bound details into the right downstream path, whether that's policy administration or delegated reporting.

By standardising the output from the underwriting workflow, you reduce manual packaging and keep post-bind processes consistent.

Teams often lose time after bind, copying details into other systems or rebuilding bordereaux from scratch.

Our platform automates these outputs from the same source of truth and integrates neatly with your policy admin.

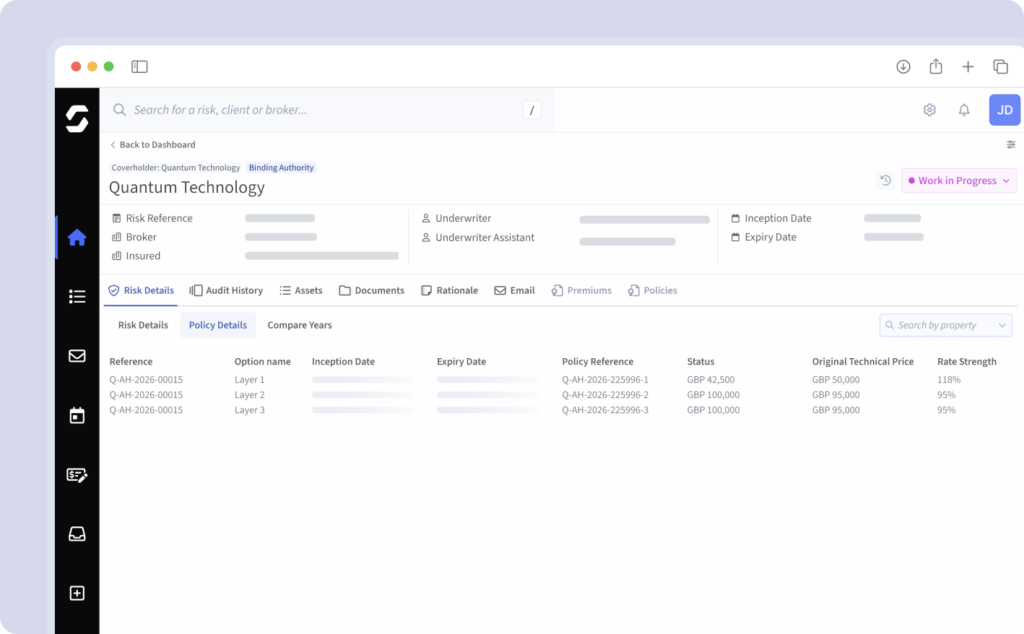

Push to Policy

Automate the capture of bound policies in your policy system of record.

Reducing rekeying and keeping downstream data consistent.

Bordereaux Generation

Generate structured bordereaux files for reporting business written back to the insurer.

Making delegated reporting faster, cleaner, and easier to repeat.

Underwriting that works together.

Customer spotlight

Customer Story

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Guide

Download guide

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Trends

Read more

Top 10 insurance industry trends shaping underwriting in 2026

Insights

Read more

Is your underwriting platform really delivering business value?

Insights

Read more

2026 – The year automated underwriting truly lands in London?

Company News

Read more