Keep complex commercial and specialty quotes under control

Track quote stages, structures, and outcomes in

one place – so underwriting teams maintain clarity as options evolve.

Complex quotes become hard to manage when options, structures, and statuses are spread across different systems.

Quote and Rate Lifecycle Management provides a single place to track quote stages, outcomes, and policy structures – from first quote to bound, not taken up, or not required.

By keeping a consistent data model from quote to bind, teams reduce tracking errors and maintain visibility without rekeying.

Offline trackers lose the details that matter. Our platform keeps options, structures, and statuses connected so underwriting stays precise as quotes get complex.

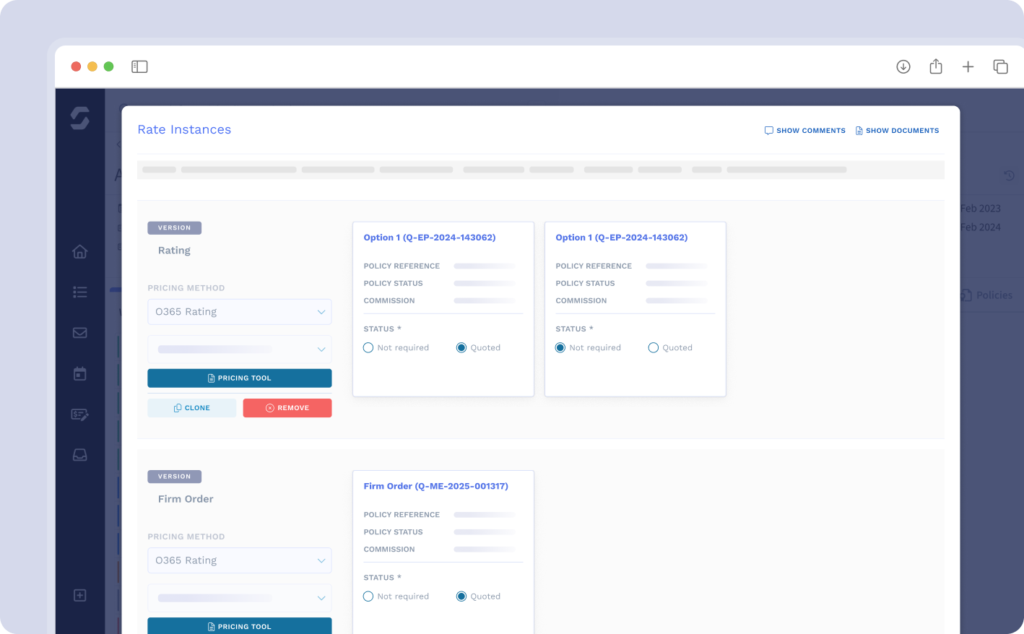

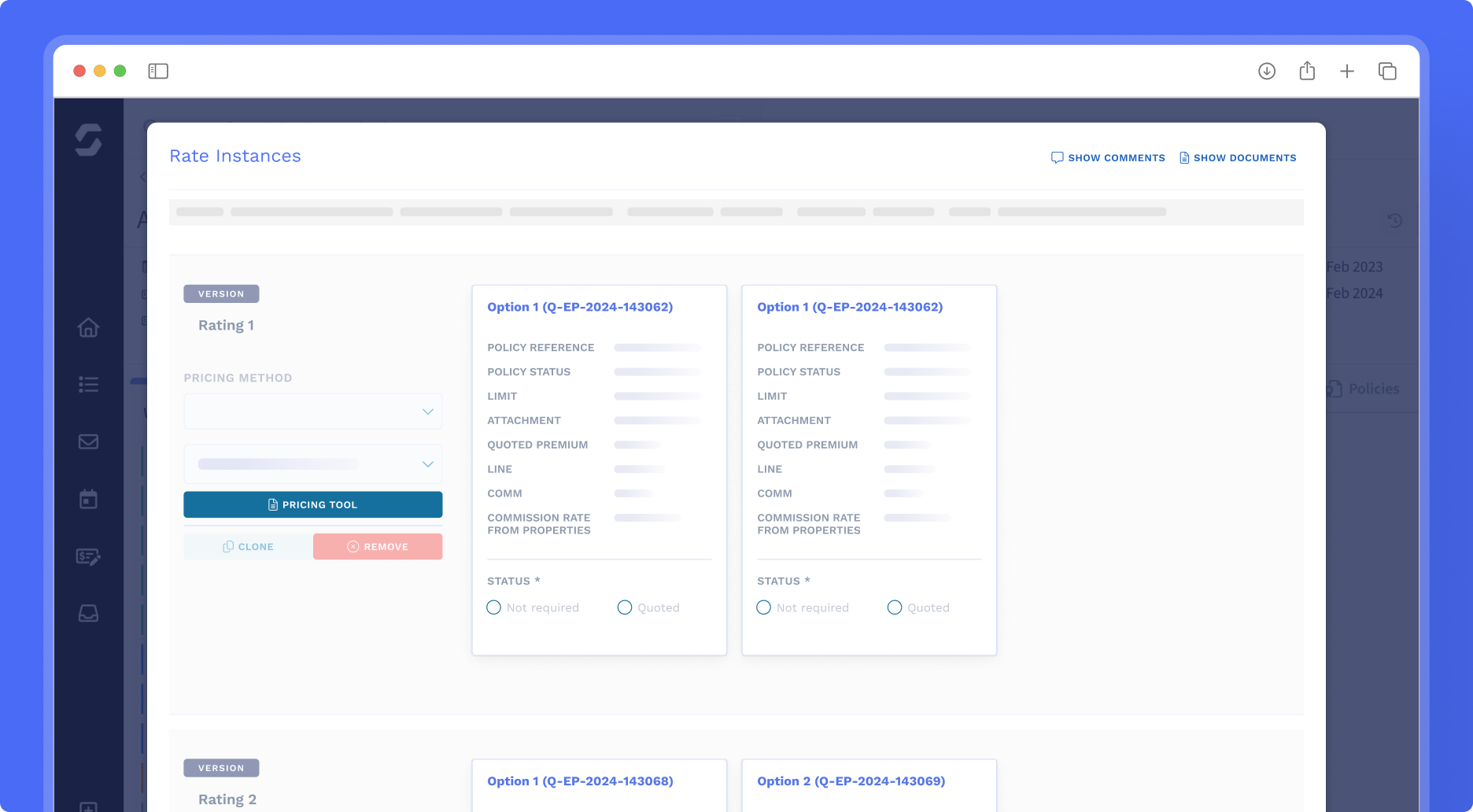

Multi-stage quote tracking

Track quoting, quoted, not required, bound, and not taken up across all quote options.

Giving managers real-time pipeline visibility and clearer conversion insight.

Flexible risk structuring

Support complex structures with layers and coverage parts, either upfront or built during quoting.

Keeping underwriting flexible without losing structural control.

Rating method flexibility

Support offline rating capture alongside integrated methods when needed.

Helping teams onboard faster and expand into new lines without day-one integration dependency.

Unified policy data model

Maintain consistent data from quote through bind for like-for-like comparison and downstream integration.

Reducing rekeying and improving data quality across the lifecycle.

Standardised rating interface

Provide a common experience across different rating approaches, including Excel and integrated engines.

Reducing cognitive load and minimising input errors when switching methods.

Enhanced Capabilities

Specialised functionality to extend your core capabilities.

Send Rating

Add integrated Excel rating and third-party pricing model integrations with Send Rating.

Pricing belongs inside the underwriting workflow, not outside.

When rating sits outside the workflow, underwriters are forced into copy-paste processes, disconnected spreadsheets, and unclear version control. This means slower quotes, inconsistent pricing, and unnecessary risk.

Send Rating embeds pricing directly into your underwriting workflow. Excel-based raters and third-party rating engines are integrated and part of your underwriting process.

Underwriters work faster. Pricing stays consistent. Governance improves. All without forcing teams to abandon pricing tools that already work.

Send Studio

Add structured document generation, clause management, and controlled document workflows with Send Studio.

Documents should be ready when you are. Yet teams waste hours copying data into templates, tracking down the right forms, and verifying attachments before anything goes out the door.

Send Studio builds documents directly from the underwriting workflow. Quotes, binders, and policies are created automatically from live underwriting and pricing data, with required forms attached based on clear business rules.

Documents are sent faster. Underwriters stay focused on risk. Compliance becomes automatic, not a last-minute check.

Underwriting that works together.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026