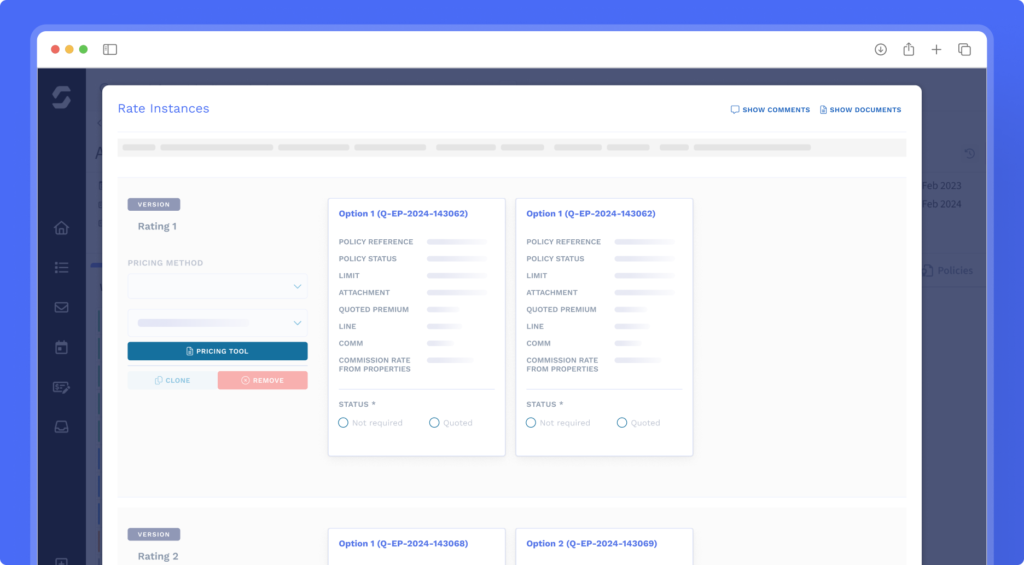

Price risks faster, with consistency and control, using the tools your teams already trust

Pricing belongs inside the underwriting workflow, not outside.

When rating sits outside the workflow, underwriters are forced into copy-paste processes, disconnected spreadsheets, and unclear version control. This means slower quotes, inconsistent pricing, and unnecessary risk.

Send Rating embeds pricing directly into your underwriting workflow. Excel-based raters and third-party rating engines are integrated and part of your underwriting process.

Underwriters work faster. Pricing stays consistent. Governance improves. All without forcing teams to abandon pricing tools that already work.

Pricing precision and speed, built into the underwriting workflow.

Integrated Excel rating

O365 Excel-based pricing connects directly to your underwriting, so you can continue using the Excel models you've refined over years.

Keep pricing where underwriters work

Choose your preferred rating approach with Excel-based models and third-party rating engines all in one platform.

Quote faster without sacrificing accuracy

Connected pricing removes rekeying and delays, helping teams respond quicker with more confidence.

Apply consistent pricing across the business

Shared models, assumptions, and logic are applied uniformly across teams and lines of business.

Ensure trusted pricing from clean risk data

Built-in controls validate inputs so pricing is always based on accurate, complete risk data.

Maintain full pricing governance and auditability

Complete version history shows who priced what, when, and using which model.

Send Rating keeps pricing close to the risk, with the speed and precision underwriters need – and the control the business expects.

Add more power to your underwriting

Specialised functionality to enhance how your teams work and unlock deeper capabilities as your needs evolve.

Send Rating

Connect your preferred pricing tools directly to the underwriting workflow.

Send Studio

Document generation and management for quotes, wordings, and binder packs.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026