Generate and send documents quickly and consistently without any of the manual assembly required

Documents should be ready when you are. Yet teams waste hours copying data into templates, tracking down the right forms, and verifying attachments before anything goes out the door.

Send Studio builds documents directly from the underwriting workflow. Quotes, binders, and policies are created automatically from live underwriting and pricing data, with required forms attached based on clear business rules.

Documents are sent faster. Underwriters stay focused on risk. Compliance becomes automatic, not a last-minute check.

Turn underwriting decisions into documents, instantly.

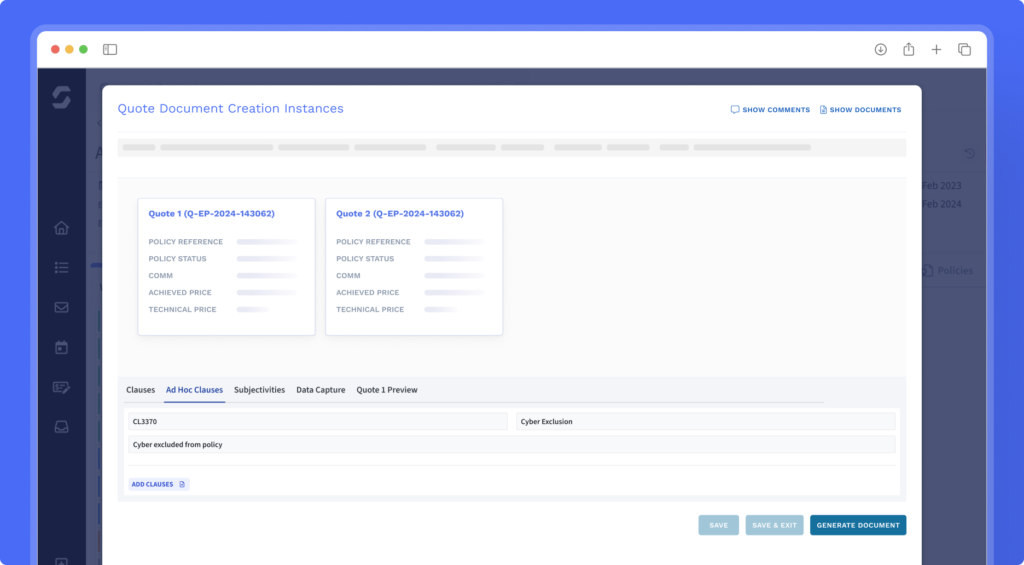

Generate quote-ready documents in minutes

Create complete, compliant quote packs, binders, and policies in minutes instead of hours.

Reduce E&O risk automatically

Mandatory forms and disclosures attach based on your rules, reducing omissions and errors.

Maintain consistent wording across the business

Governed templates ensure documents stay aligned across teams and lines of business.

Support complex risks without manual rework

Documents adapt to layered programmes, multiple sections, and variable policy structures automatically.

Verify documents before they’re sent

Instant previews allow underwriters to confirm accuracy and completeness with confidence.

Stay audit-ready at all times

Every document is traceable to the exact data and form versions used at the time of generation.

Spend less time assembling documents and more time assessing risk.

Add more power to your underwriting

Specialised functionality to enhance how your teams work and unlock deeper capabilities as your needs evolve.

Send Rating

Connect your preferred pricing tools directly to the underwriting workflow.

Send Studio

Document generation and management for quotes, wordings, and binder packs.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026