Underwrite at full speed with compliance built in

Compliance should support your growth,

not complicate it.

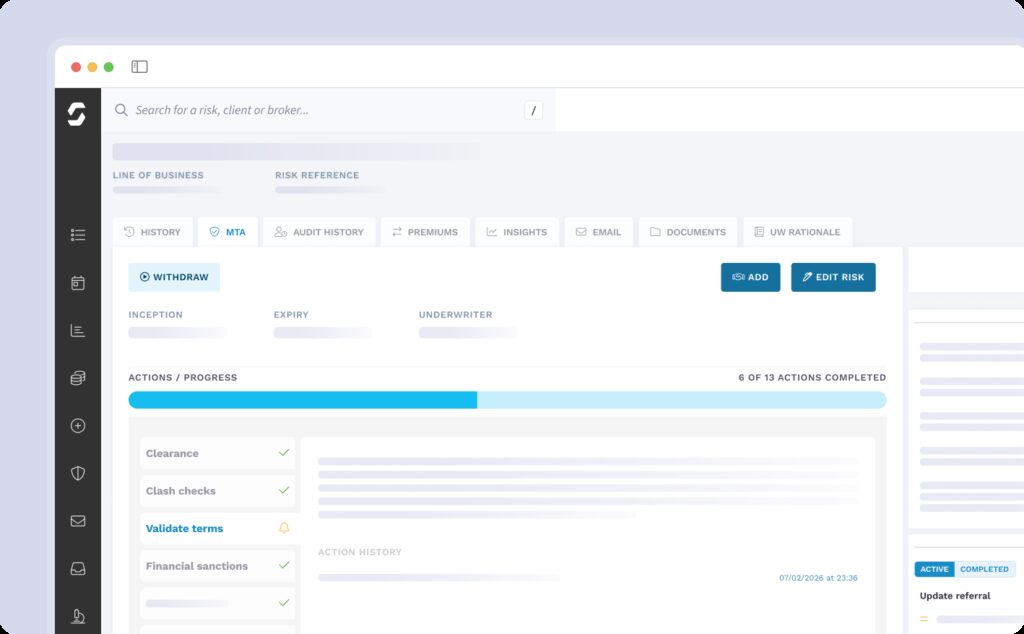

Compliance gets hard when checks are manual, inconsistent, or done too late.

Risk Workflow embeds clearance, validation, and auditability directly into the underwriting process.

With automated background checks and structured evidence capture, teams move faster while maintaining robust standards.

Compliance needs to be part of your underwriting workflow without getting in the way.

Checks run in the background and capture proof as you go – making compliance routine, not reactive.

Clearance and compliance checking

Run automated checks with specialised insurance APIs with a full audit trail.

Reducing manual due diligence while improving traceability.

Clash checks

Identify overlaps and duplications early in the process.

Avoiding reputational risk and improving broker experience.

Validate terms and conditions

Validate requirements against predefined criteria and checklists with supporting documentation.

Helping teams process risks with confidence that standards are being met.

Financial sanctions

Automate sanctions screening as part of the underwriting flow.

Saving time while keeping controls consistent.

Underwriting that works together.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026