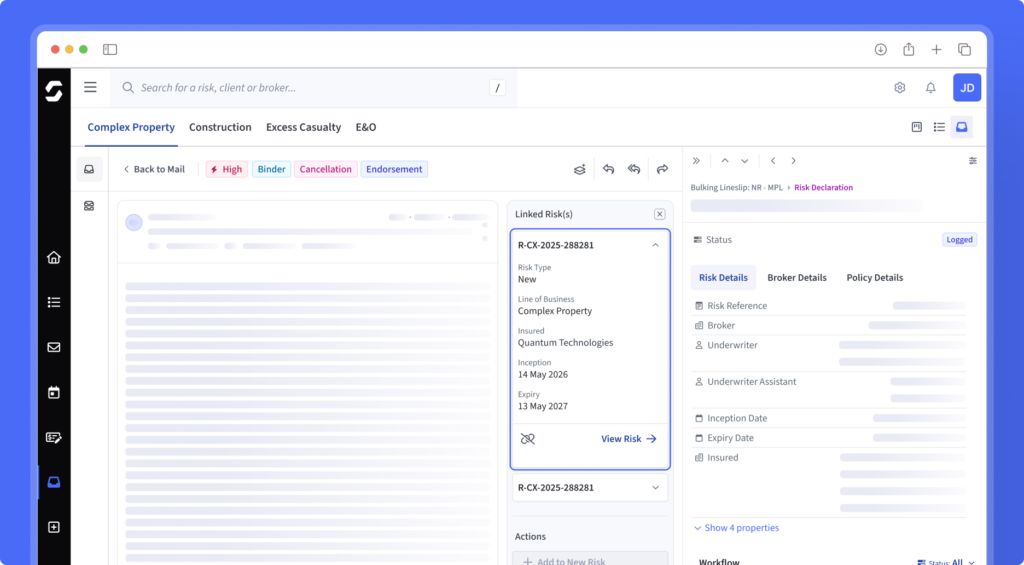

Turn chaotic submissions into trusted data that drives higher submission-to-quote conversion

Every carrier wants faster submissions, lower costs, and less manual effort.

But commercial and specialty risks are complex, and submission data rarely arrives in clean, structured formats.

Send Flow applies intelligent automation to organise and validate submission data at the point of intake. Routine steps are handled automatically, while underwriters stay in control of the decisions that matter.

The heavy lifting is removed. Complex tasks are simplified. Every submission becomes easier to process.

The result: cleaner data, faster triage, and greater confidence in every underwriting decision.

7x faster time to quote.

Easily prioritise risks in appetite, saving you time and improving your win rate.

Less submission busywork

Automate intake from shared inboxes and portals so underwriters spend less time chasing attachments and rekeying data.

Cleaner, decision-ready data

Convert unstructured submission packs into consistent, structured data in your workbench or PAS, reducing errors and duplication.

Early confidence in appetite check

Apply appetite checks at intake to filter out-of-strategy risks early and route the right opportunities to the right desk.

Focus on the best opportunities

Prioritise submissions by broker, win-rate, and strategic fit - not just first in - so the highest-value risks are worked first.

One controlled submission pipeline

Centralise and deduplicate submissions across brokers and channels for a single, reliable view of every risk.

More time for underwriting judgement

Remove low-value admin so underwriters focus on analysis and decision-making, not data entry.

Avoid the submission drudgery.

Send Flow quickly turns unstructured broker emails and documents into structured data your underwriters can act on, and trust.

Add more power to your underwriting

Specialised functionality to enhance how your teams work and unlock deeper capabilities as your needs evolve.

Send Flow

AI-powered submission processing for faster underwriting.

Send Rating

Connect your preferred pricing tools directly to the underwriting workflow.

Send Studio

Document generation and management for quotes, wordings, and binder packs.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026