The smarter way to structure and manage reinsurance programmes

Reinsurance programmes move fast and change often. Send gives underwriting leaders a single source of truth to maintain control, governance, and portfolio insight – without slowing teams down.

Run treaty and facultative underwriting in one workspace, with pricing, participation, and authority kept in sync as programmes evolve.

Build reinsurance programmes once – and trust them.

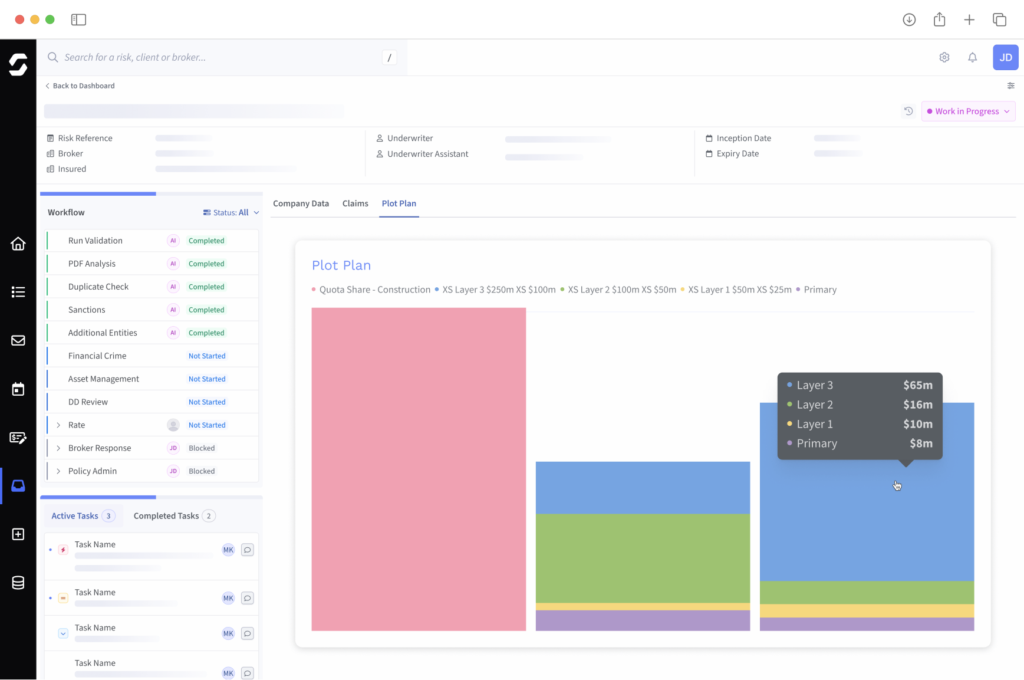

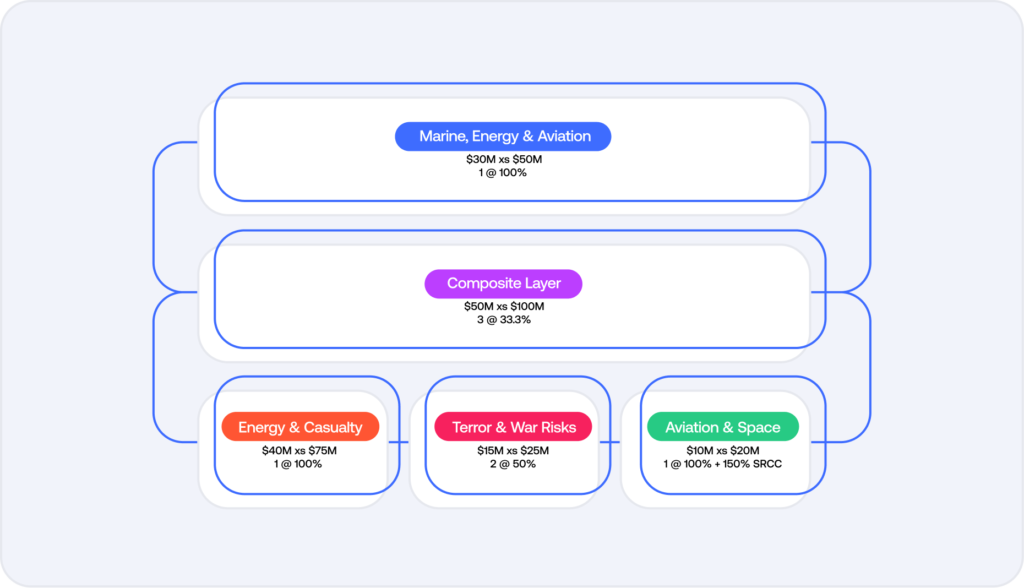

Capture treaties and facultative deals with the layers, shares, and terms underwriting needs. Stop rebuilding structures in spreadsheets.

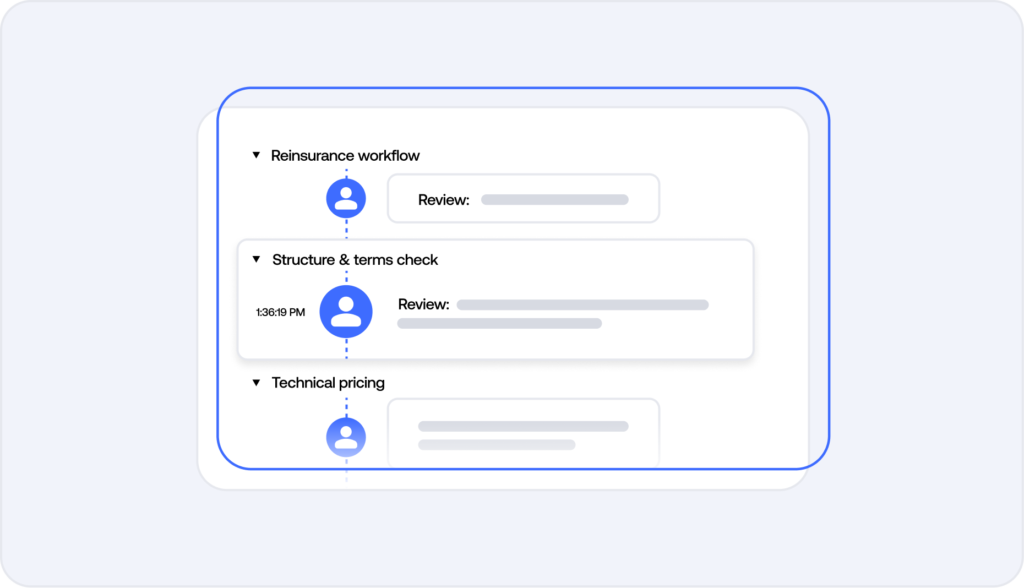

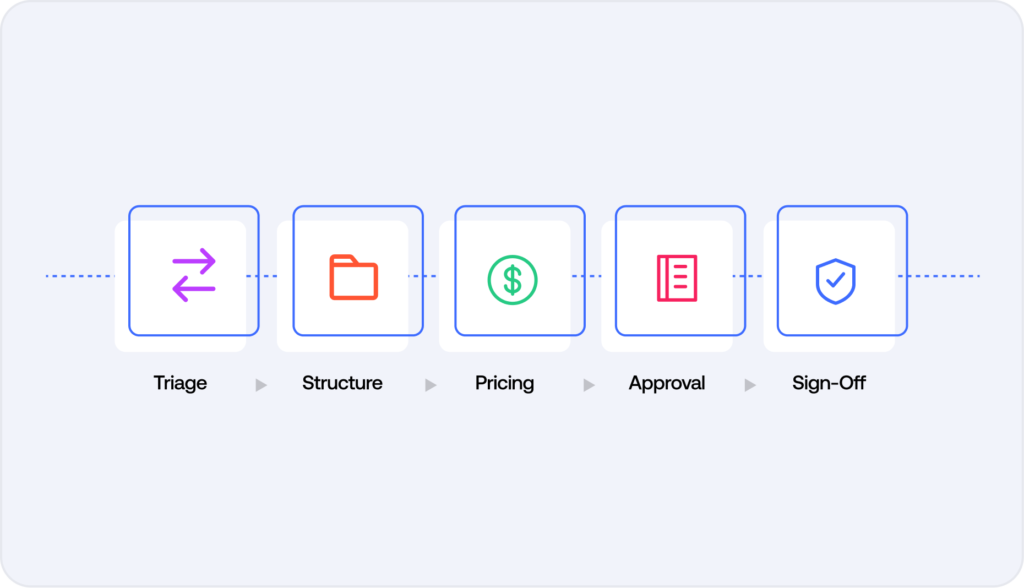

Keep decisions moving without losing context.

Move work through triage, review, referrals, and sign-off while keeping decision rationale tied to the record.

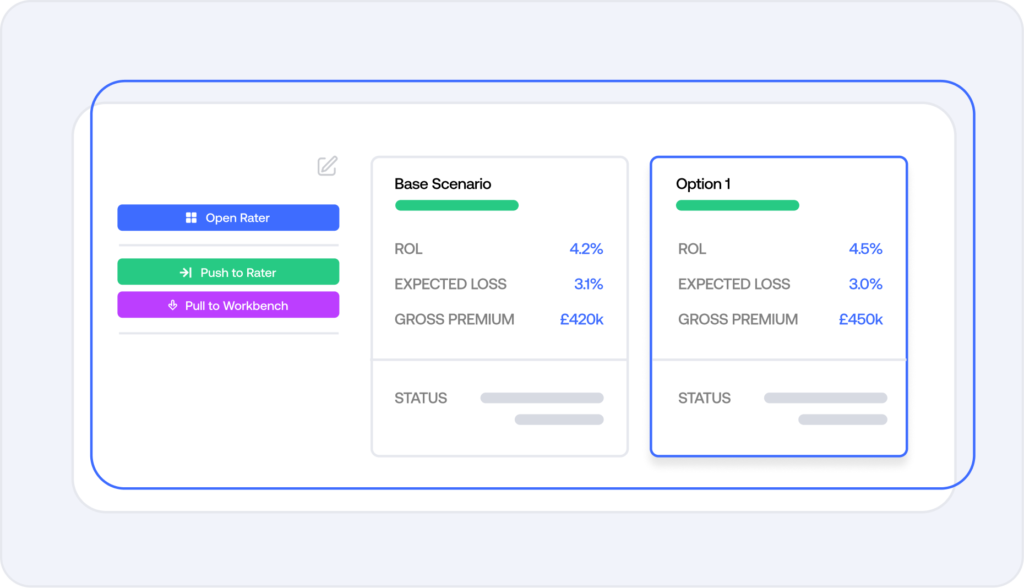

Reach pricing decisions faster, with confidence.

Bring models and pricing workflows into the underwriting process so teams stop switching tools to get to a view they trust.

Enforce governance without slowing underwriting.

Apply authority and decision logic consistently with a clear trail of changes and outcomes.

Oversight improves without slowing teams down.

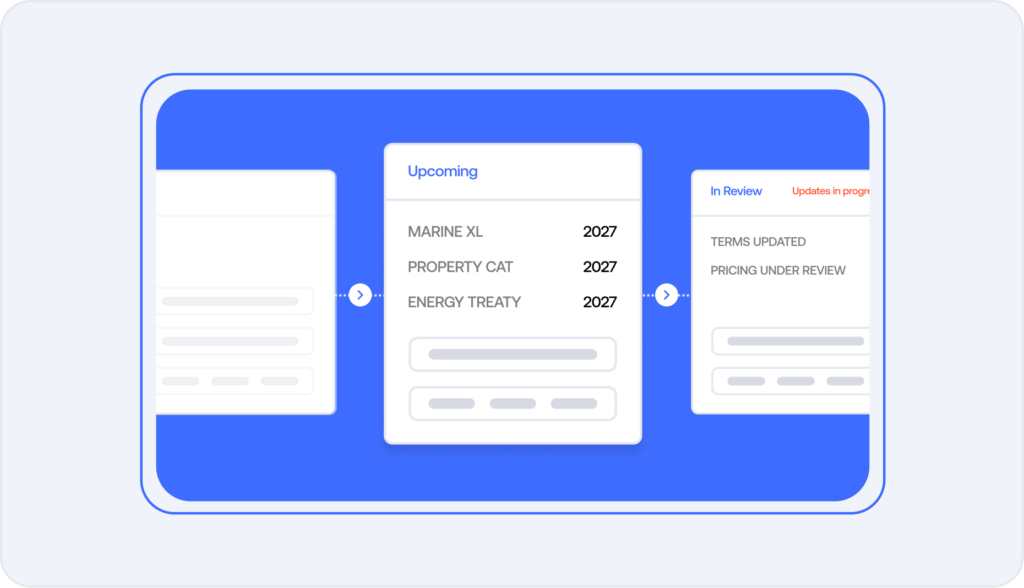

Run renewals with clarity, not the scramble.

Track what changed, what was agreed, and what is outstanding. Renewal season becomes controlled rather than reactive.

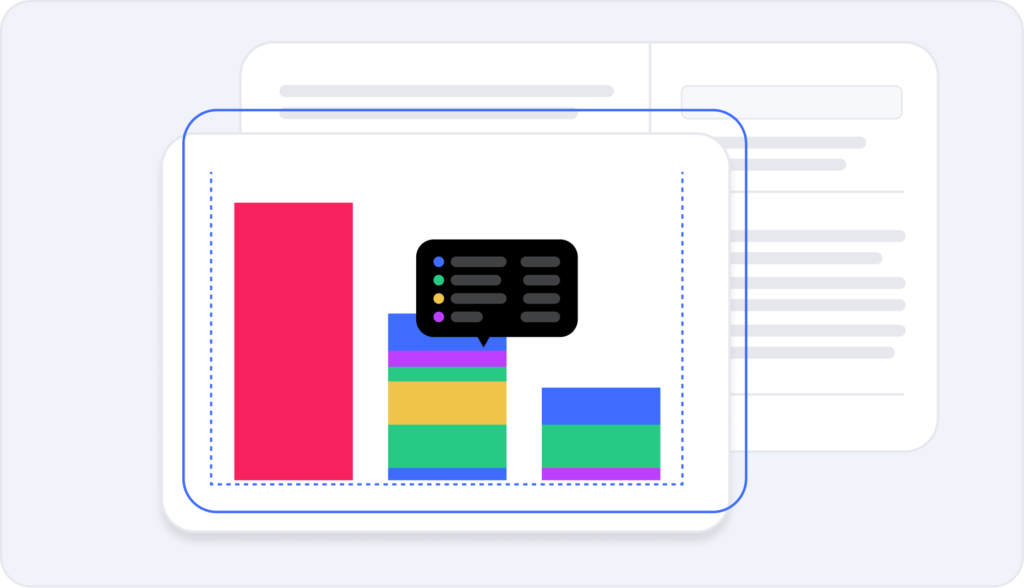

Act earlier with real-time portfolio insight.

Use real-time views to understand pipeline, outcomes, and book movement so you can respond earlier.

Programme structure, pricing, authority, and documentation stay connected, giving teams a single source of truth across treaty and facultative business.

Add more power to your underwriting

Specialised functionality to enhance how your teams work and unlock deeper capabilities as your needs evolve.

Send Rating

Connect your preferred pricing tools directly to the underwriting workflow.

Send Studio

Document generation and management for quotes, wordings, and binder packs.

Who is this for

Reinsurers

The underwriting backbone for reinsurers – bringing structure, pricing, and insight together in one place.

A full API library to accelerate your

growth and scale your operations.

Using our API-first architecture, underwriters can collect data once and ensure it remains accessible throughout the process, with ready-to-use data sources like HX, D&B, Hazard Hub, and many others.

Pre-built workflows and data models for more than 40 lines of business

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026