How mature is your underwriting?

Insights from the IUA Webinar with Head of Product Strategy, Will Harnett.

The International Underwriting Association recently hosted a webinar to examine a critical but often elusive question for carriers: How mature is your underwriting function?

The session was led by Will Harnett, Head of Product Strategy, who drew on his experience across both the London and US markets.

Strategy before technology

Underwriting maturity doesn’t begin with adopting the latest platforms or AI tools, instead, it starts with intent and alignment. A company or even an individual team must be clear about its goals before layering in technology; otherwise, inefficiency simply becomes automated.

Before insurers can make real use of advanced analytics or AI, they must get the fundamentals right. That means building consistent workflows, ensuring compliance can be measured, and agreeing on the relatively small number of data points that truly drive underwriting decisions. Just as important is documenting underwriting rules so they can be applied consistently. Without these building blocks, transformation initiatives struggle to deliver sustainable change.

Underwriting maturity is not defined by technology alone, but by underwriting strategy and the ability to make data meaningful in practice.

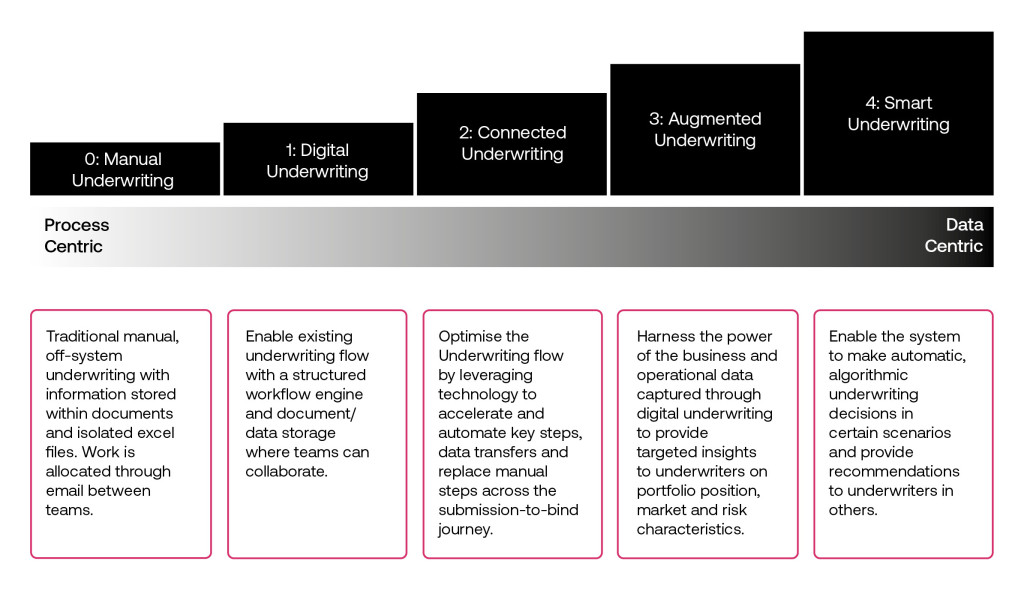

Mapping the Journey

Underwriting maturity is an evolutionary journey, moving from manual processes to digital workflows to connected underwriting, where broker and third-party data are embedded directly into the process. The more advanced stages involve augmented underwriting, where analytics and AI provide deeper insights, and ultimately dynamic or “smart” underwriting, where risk appetite and pricing can be managed in real time at portfolio level.

Most carriers are operating somewhere between digital and connected underwriting, with only a handful reaching the augmented stage.

Interestingly, US carriers tend to be more comfortable embedding data into the business process, while the London Market is still consolidating its digital foundations, though the momentum to move forward is strong.

Dealing with legacy

One of the recurring obstacles is legacy technology, often accumulated through M&A. Carriers frequently operate multiple outdated systems in parallel, creating complexity for underwriters. This is an age-old problem, but modern orchestration layers can shield underwriters from these inefficiencies, providing a unified experience while enabling firms to retire older systems gradually. This allows progress to continue without waiting for a full-scale system overhaul.

If you're starting from a clean slate, it’s fundamental to adopt a data-first mentality.

By centring underwriting processes around high-quality, structured data from the outset, newer entrants can bypass many of the legacy challenges established carriers face. Good examples are cargo and fleet underwriting, where IoT and real-time data allow insurers to price risks more accurately, not necessarily higher or lower, but with greater adequacy against the true exposure.

The value chain

Historically, the only structured underwriting data sat in the PAS, and it reflected only a slice of what underwriters use. Much of the rest lived in documents and emails, making it hard to align data across brokers, carriers, coverholders and reinsurers. Common submission data standards help close that gap.

Today there is no shortage of data. The issue is integration. PAS data is often the only structured feed that lands in the EDW or reporting mart, so a lot remains unseen. The priority is to model and route submission data consistently and then enrich it. In that context, AI can help classify, extract and validate information, but it works best once the target data model and rules are clear.

Real change comes when underwriters, operations, data, and technology teams work together.

Technology on its own cannot deliver underwriting maturity. The most successful projects are those built collaboratively rather than through siloed handovers.

Risk transformation, not just digitisation

It’s worth noting that underwriting maturity is not about digitising what already exists but about transforming how risk itself is understood and managed. Insurers that focus on clean data, clear rules, and cross-functional alignment today will be best positioned to take advantage of AI and advanced analytics tomorrow.

Technology is an enabler of maturity, not its definition. For the London Market in particular, the challenge is to close the gap with international peers, work around legacy systems, and embed a data-first culture at every stage of the value chain.

For carriers asking themselves “How mature is our underwriting?”, the answer lies less in the tools they buy and more in how well they align strategy, process, data, and people.

To learn more, download our guide to Underwriting Maturity in an Evolving Market. Connect with Will Harnett on LinkedIn.

- Insights

Related Resources

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026