The Bowhead Story - building a digital-first provider

Commercial Lines Innovation USA, run by Intelligent Insurer, is one of the leading conferences for senior insurance innovators in North America.

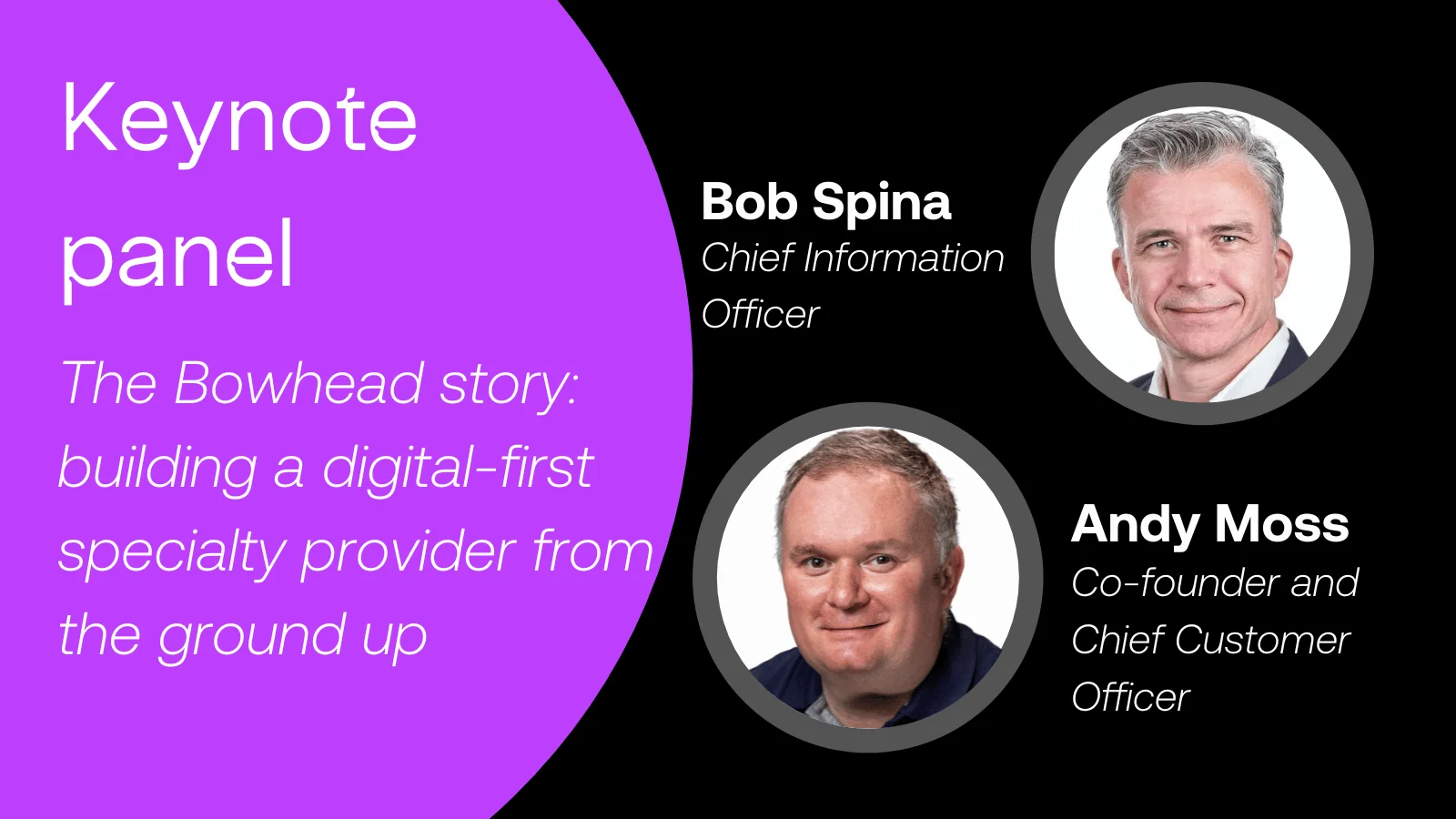

In a keynote panel, Bob Spina, CIO at Bowhead Specialty, shared his story on becoming a leading digital-first specialty lines provider. During the session Bob reveals the secrets to digital underwriting success - it's a really interesting session and you can catch a replay of it on the link below!

Key take-aways include:

- How emerging technologies enable Bowhead Specialty to strike the right balance of resources when underwriting ‘craft’ and ‘flow’ business

- That you don’t need to surrender to submission ‘chaos’, there are smart ways to automate submission flow (key for mobilising speed to improve broker relations)

- The role of data as the "bedrock" for all benefits in Commercial Lines innovation

- It's important to focus your underwriting system on limited handoffs, not only for a unified experience but to get the right information flowing downstream

- The role Send played in the successful launch and fast scale-up of a new specialty lines insurer.

Happy viewing!

Categories:

- Insights

Related Resources

Underwriting Resources

Guide

Download guide

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Trends

Read more

Top 10 insurance industry trends shaping underwriting in 2026

Insights

Read more

Is your underwriting platform really delivering business value?

Insights

Read more

2026 – The year automated underwriting truly lands in London?

Company News

Read more