Underwriters, you can have it all

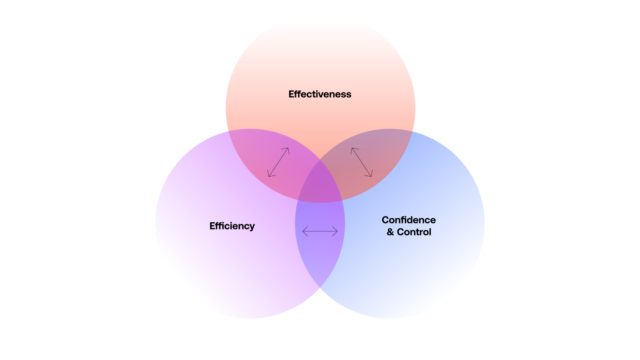

Effectiveness. Efficiency. Control. The three essential pillars of any robust underwriting team. Until now they’ve had to compete for prioritisation – always choosing which ones to sacrifice. But no more. In this short blog, I’ll show you how you can indeed have it all, if you invest in the right technology.

Let’s look at these competing priorities of underwriting in more detail:

Effectiveness

The core of underwriting – select the right risks, structure the right product for the customer and set the right price. The ability to leverage data and AI powered insights to achieve better risk selection, better pricing and more effective portfolio management. Effective underwriting businesses can improve their loss ratio and grow GWP through better risk selection.

Efficiency

How much collective time and effort does it take to make and support underwriting across the whole function. Efficient underwriters aren’t bogged down in tedious manual processes, they can harness automation to process the simple activities leaving them free to focus on more value-added business tasks like nurturing their broker relationships and growing the business. Efficient underwriters can increase their quote to bind ratio, generate high premium per underwriter and improve their expense ratios.

Control

The level of risk involved in your underwriting. Confidence in control is gained by having the right audit trails and control in place to know that underwriters are writing sounds, compliant business, with automated sanctions and licensing checks and authority limits. With confidence and control, underwriters can expand their appetite, reduce E&O risk and get a single view of their customers. Leadership can have real time visibility of how their teams are operating and peace of mind that the risk of regulatory breaches are minimised.

Ideally underwriters should be able invest in these priorities equally, however it’s been historically difficult to prioritise all three, and insurers have been forced to sacrifice one or more, particularly in the London market.

Underwriting complex, specialty risks has historically been an art. Experienced underwriters have honed their skills over years, using their expertise and trained judgement to navigate these risks. Attempts to assert too much control and rigidity can constrain underwriters and force them into adopting processes and workflows that don’t reflect the fluid nature of effective underwriting These sorts of transformations have inevitably failed through lack of true user adoption – with activities happening offline and being retrospectively logged, rendering the controls and MI compromised.

Equally, it’s been traditionally difficult to make underwriting complex risks more efficient. Their highly varied structures across brokers, classes and risks has made automation hard to achieve, so knowledge and skills remains with the individual underwriters, which also poses a risk for future talent retention.

Fuelling future evolution

We’ve now reached a turning point. The volume of quality data and broader application of AI has the potential to increase underwriting effectiveness exponentially; data powered risk triage and pricing is fast becoming table stakes. But in order to reap maximum benefits we have to be able to access and interrogate data sets more efficiently – manually rekeying huge data sets across multiple systems for each submission just isn’t feasible. If you are going to make faster, more data driven decisions, you also have the mechanisms in place to ‘bake in’ confidence that the data is accurate and controlled securely.

Today’s underwriting platforms have had to evolve quickly to help underwriters to leverage this data and support all three priorities, it’s critical for underwriters to be able to find the tools to handle these changes and mature in line with the market. The journey with data and AI is just beginning and whilst the leading AI models and data services will change – Underwriting teams need a backbone to their operations that can be the constant.

This is where Send comes in. Instead of competing, our Underwriting Workbench allows these priorities to fuel each other, creating a cycle of value that helps underwriters to evolve.

No compromises

Send’s Underwriting Workbench is built to support underwriters work the way they want, with no strict linear processes to follow. We have built workflows and templates for a huge variety of business lines that mirror the way skilled underwriters perform their art.

We fuel efficiency with the latest AI and automation tools to reduce administrative burden, and give underwriters time to tackle the more complex risks which require creative solutions.

We automate time-consuming compliance tasks and have a full audit trail, giving underwriters confidence in quality of the risks they right.

Rather than forcing underwriters to choose between priorities, our platform accelerates all of them, and allows them to fuel not fight each other.

We believe the best underwriters can have it all without compromise, and would love to chat about this in more details.

Written by Lloyd Peters, Head of Revenue UK and EMEA. Contact me to find out more about how we can help fuel your underwriting business.

- Insights

Related Resources

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026