Underwriting in 2026: margins, human judgement & AI will decide winners

In 2026, underwriting will face a collision of forces. From margin pressures to adoption of AI to climate volatility and the talent exodus. It will be a great convergence. The result?

The underwriting playbook will be rewritten. Underwriting will turn towards margin-first models. From submission to quote, the workflow will be complemented by AI, and underwriters will spend more time managing portfolios and mentoring less-experienced colleagues.

Yet technology alone won’t define underwriting. Human judgement will be valued more than ever as context will be the differentiator in underwriting decisions. So, what should insurers get right as underwriting enters this new era?

Send’s ‘Top Underwriting Trends Defining 2026’ webinar in collaboration with Business Insurance, revealed some unique perspectives. Panellist Brad Tabor, Head of Revenue, North America at Send, emphasized that AI’s true value lies in execution, and Cliff Laidlaw, Senior VP, Markel, highlighted that AI can only succeed when built on minable data, strong governance, and adaptable platforms. James Miller, retired CUO, meanwhile, stressed that human judgment will remain the ultimate differentiator, particularly in complex or volatile markets. Read on to discover practical steps insurers take today to stay ahead of these seismic shifts.

More margin pressure = new underwriting rules

Insurance has always been a game of margins. But those margins are now getting narrower than ever. Profitability is under scrutiny due to rising costs, increased CAT events, expensive reinsurance, and operational inefficiencies. As Cliff noted, it now simply costs more to run an insurance business, making expense ratios a central focus for underwriting leaders. James also felt the pressure was being compounded by a prolonged mixed market and widespread retirements.

Traditional underwriting models were built for stability and predictability and are unable to keep up with constant uncertainty. Hence, AI is emerging as a critical tool to reduce time and cost to reach underwriting decisions. According to Brad, expense and loss ratio control will be one of the biggest differentiators for insurers in 2026. AI will supplement underwriters to select better risks, reduce errors, and write more profitable business. Routine tasks will be automated, decisions will rely on mineable data, and continuous feedback loops with data, technology, and operations will be applied effectively.

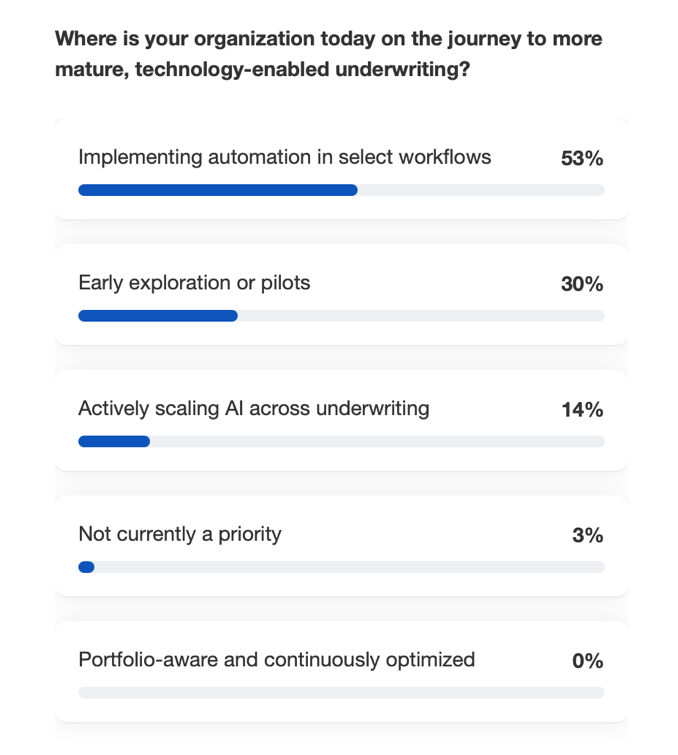

Audience polling during the webinar confirmed that insurers today are on a journey towards technology-enabled underwriting. 53% indicated that their organizations are currently implementing technology in select underwriting workflows. From conversations in the market, Brad confirmed that most carriers are taking incremental steps, testing automation and intelligence in targeted areas. James added that many organizations aspire to have complete underwriting modernization, but traditional insurers remain held up by legacy systems.

Not just automation, the new year will redefine underwriting intelligence

The panel collectively agreed that underwriting has now evolved into an agent-led intelligence. This evolved AI model works alongside underwriters, sourcing the desired information, interpreting risk in context, and aligning to margin goals. Instead of searching for answers, underwriters receive structured, prioritised intelligence where it matters most. Brad highlighted that modern underwriting platforms bring data, intelligence, and workflow into a single decision window. It surfaces key risk insights, embeds underwriting intent, prioritises submissions, and connects individual risks to portfolio, amplifying judgment while protecting margins.

However, Cliff emphasized that this progress depends on model quality. AI is only as strong as the data it’s trained on, and insurers must continuously improve information quality and governance. While AI adoption has accelerated rapidly, its success depends on thoughtful implementation, not untrained models or disconnected data underwriting throughout.

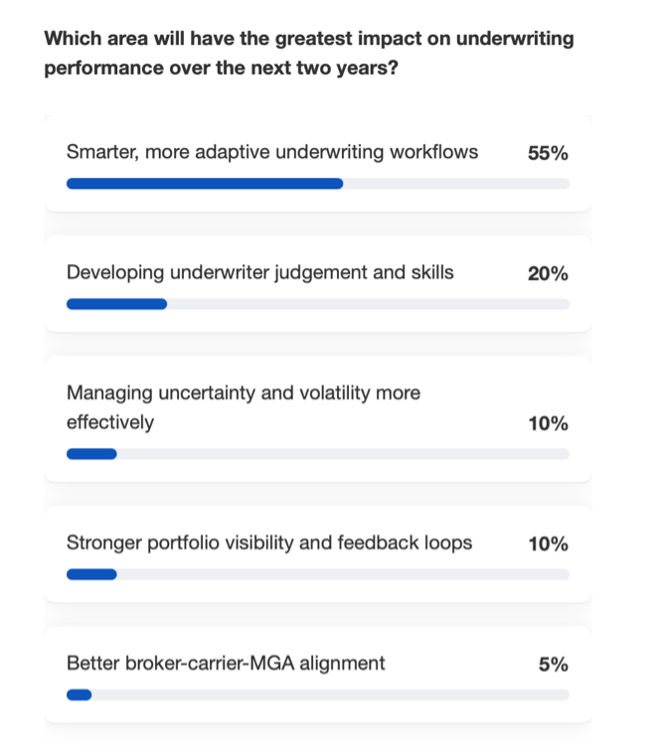

When asked which area would have the greatest impact on underwriting performance over the next two years, 55% of the audience selected smarter, more adaptive underwriting workflows. Brad agreed with the audience that underwriters increasingly want solutions tailored to their specific lines of business. James added that looking ahead to 2026 and 2027, insurers may be surprised by portfolio viability challenges, suggesting that data quality, consistency and underwriting judgment could ultimately have a greater impact than workflow improvements alone.

Prepping the next generation of underwriters

According to the U.S. Bureau of labour Statistics, an estimated 400,000 insurance employees are expected to retire in the United States in the next few years. Decades of industry experience are at risk of disappearing unless transferred to the new generation of insurers. Cliff highlighted that the industry is sitting on massive data that needs to be captured by the new talent. Data training and literacy must begin simultaneously alongside underwriting and actuary learning. He reiterated that data literacy is going to be a critical skill for the next generation, enabling underwriters to apply AI-driven insights effectively. Brad complemented this idea that the younger talent joining the workforce utilises technology so well that it can be a great exchange of skill sets between the veterans and the freshers. This talent exchange can encourage veteran insurers to spend a few more years developing capability across operations, technology, and data science, opening new career paths as well.

James reiterated that while technology is a key factor in underwriting success, young underwriters must not completely rely on AI and develop critical thinking. He recollects instances of how technology has failed miserably without human judgement and technology must only supplement an underwriter and not replace them.

Hybrid underwriting will eliminate administrative work for underwriters

Underwriting decisions are no longer being made in binary. They are being carried out among humans, rules, and AI with each playing a very specific role. Brad stated that the goal of any underwriting workflow is to remove conflict. An ideal underwriting model will automate traditional risks that will need only 15- 20% of human intervention. Hence, more focus can be directed to new areas where the risk appetite is unclear. This will enable insurers to scale their business and take advantage of an underwriting model. Cliff suggested that to arrive at the most efficient underwriting model, underwriters must be involved in designing and training systems, with components that can be plugged in or removed as per the requirement. This flexibility will truly free underwriters to focus on true insurance work rather than repetitive tasks. However, James once again stated that underwriting must remain a human-led discipline. He pointed out the specialty and E&S markets, where submission quality varies widely, human judgment is critical to avoid the failures that occur when technology operates without oversight.

Data readiness must be an immediate priority for insurers

When asked what underwriting and operational leaders must prioritize in 2026, Brad, Cliff and James unanimously replied, ‘Data Readiness.’ The industry has an unimaginable amount of data that needs to be extracted to feed underwriting models with more perspective. This has been a challenge for global organizations while they balance new technology with legacy systems. The panellists pointed out that unstructured data, such as claims files and underwriting notes, can be fed into underwriting models, adding more perspective to the overall output led by AI. Brad cautioned insurers that if they haven’t begun fixing their data foundations, then they must start now. He stated that these are multi-year efforts and success depends on how soon the data can be organised for AI carryout its business outcome effectively. Without usable data, even advanced AI tools will fall short of their potential. In contrast, insurers that act now will be better positioned to deploy AI effectively turning data into a durable competitive advantage.

The path ahead for underwriting is clear, but not a simple one. Success in 2026 will not come from technology alone but from a combination of strong data foundations, adaptive workflows and human judgement. Insurers must act now to organise their data, rethink their underwriting intent and invest in talent development that will not only improve efficiency but also protect margins and strengthen portfolios. AI will be a powerful enabler that will supplement experience and expertise. Those who wait, will be left behind and those who take on these challenges will emerge as the real winners.

- Insights

- webinar

Related Resources

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026