Confident reinsurance

underwriting at programme level

Manage your reinsurance underwriting from the programme view, with the detail one click away

Reinsurance programmes shift quickly across layers, terms, and renewal cycles. Teams still rely on spreadsheets, deal packs, and point tools to keep structure, exposure, and approvals in sync.

Send brings programme structure and underwriting workflow into one workspace. Documents, schedules, wordings, and decisions stay tied to the deal – giving teams the control and visibility to underwrite with confidence.

REINSURER BENEFITS

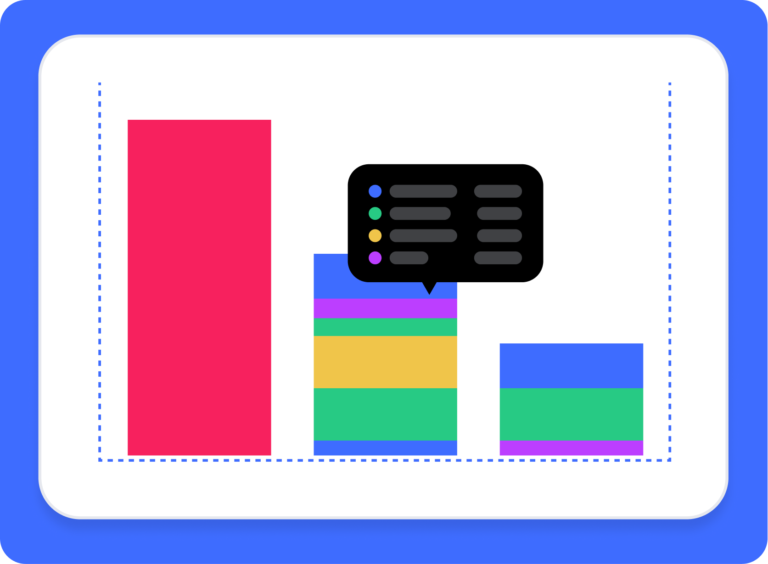

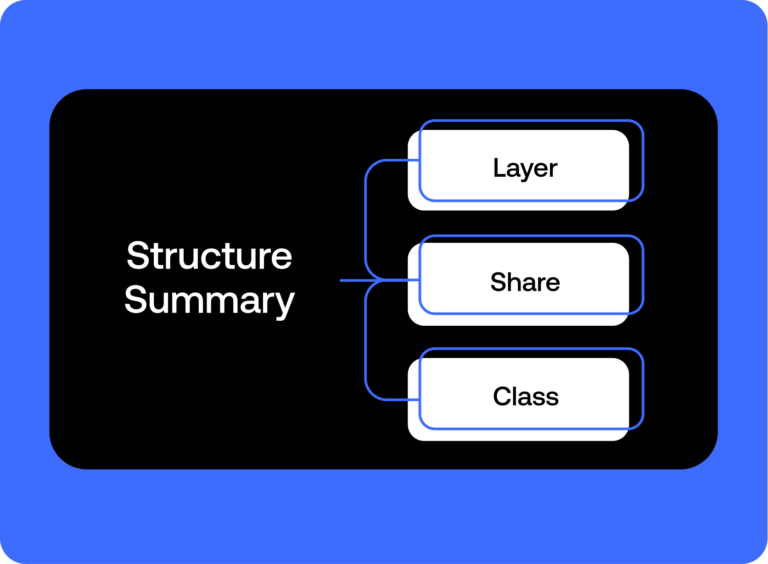

A structured view of every programme

Model programmes across layers and sections, then see exposure and performance through clear, real-time dashboards.

Risk insight that stays tied to the deal

Bring risk and portfolio context into the underwriting moment, including programme structure analysis and risk-to-portfolio views that support better decisions.

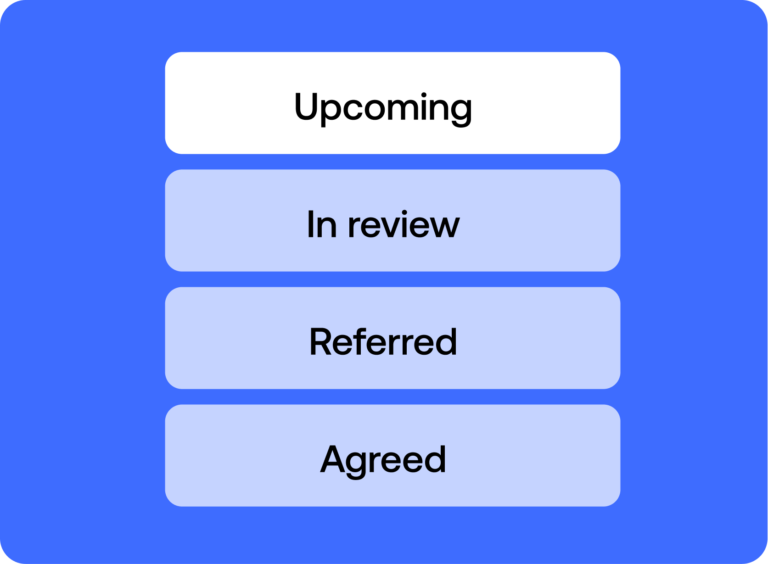

Run renewals with control and accountability

Prioritise renewals, assign work, and manage referrals and approvals with tasking that supports both individual work and managerial oversight.

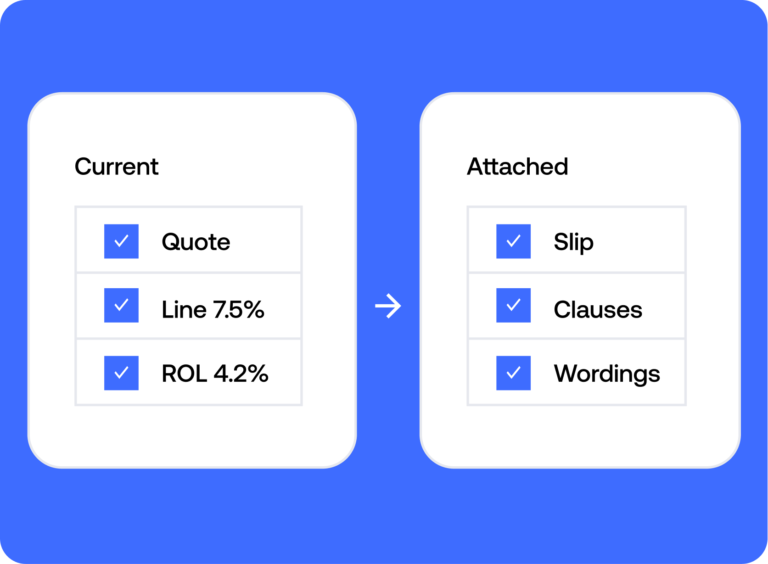

Consistent quotes and wordings

Manage multiple quote options without losing track, and keep wordings and clauses organised so the right documents attach to the right deal.

Products for reinsurers

Send for Reinsurance Underwriting

Connect programme decisions to portfolio control across your reinsurance book

Send connects programme structure, terms, and underwriting decisions to portfolio-level visibility, so teams can see exposure clearly and manage change without losing control.

Add more power to your underwriting

Specialised functionality to enhance how your teams work and unlock deeper capabilities as your needs evolve.

Send Rating

Connect your preferred pricing tools directly to the underwriting workflow.

Send Studio

Document generation and management for quotes, wordings, and binder packs.

Pre-built workflows and data models for more than 40 lines of business

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026