Understanding the ‘crowded’ Underwriting Workbench landscape

Most insurers are clear on the importance of a modern digital underwriting platform, or ‘workbench’, to the future of their business. The primary driver for change still varies by company, from quote efficiency gains & speed, channel management, control, to decision-making insight; the reality is that for most, it’s a blend of all of them. Your underwriting platform isn’t just tech, it’s not just workflow, it’s not just MI – it’s a digital reflection of your business: customers, channels, products, people, process, data, AI and tech unified in a single platform. That’s what makes this difficult, scaled insurers have extensive, complex and continually evolving operating models – a result of building varied portfolios in a competitive marketplace. So how do you support that without building inefficient, opaque silos that inhibit growth and create risk?

Most commercial and specialty insurers have already started on their underwriting transformation journey in one form or another. There have been successes and even more examples of ‘learnings’ (including a fair few extremely costly ones). Many insurers still face a choice on which path to take, whether it’s their first foray or attempt two (or three…).

The key thing I hear people struggling with is the array of different options available to them; it’s not like picking a policy admin or a claims solution, where different vendors fundamentally offer the same thing and can be compared ‘like for like.’ The underwriting platform decision is not “which solution?” but “what solution landscape?” – the question is more business/application architecture and operating model design than vendor selection. This landscape needs to cater for today’s business as well as underpinning the insurer they want to be in 5 years from now. They need a solution that helps them navigate their progression through the Underwriting Maturity Model – a journey that will differ by company, market, line, product and underwriter!

Traditional vendor selection processes in this sphere tend to leave insurers with too much information... but no clearer view of which path to take! This is made worse as vendors in most categories are seeking to grow their relevance by expanding out of their core offerings, often saying that they can do it all. Our experience is if you first decide on your target solution landscape however, selecting the right partners, based on what they do best, is much simpler as there are generally standout tools in each core category.

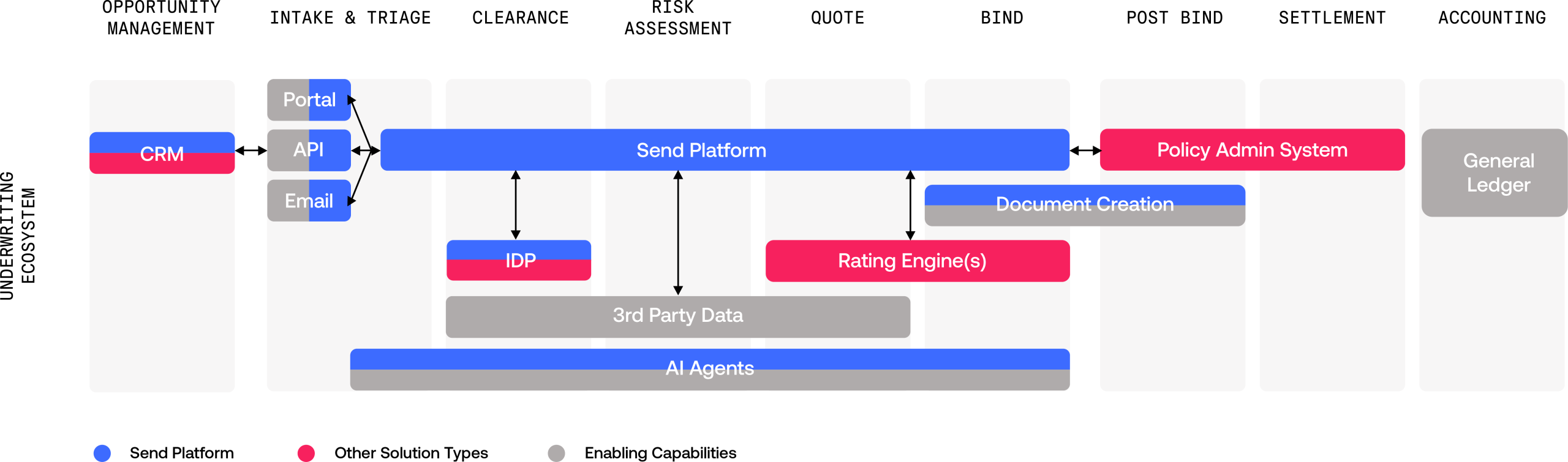

Solution Landscape

Roughly speaking, we see six categories that market ‘workbench’ functionality:

- PAS → Extend ‘left’ from post-bind into the underwriting space.

- CRM → Extend ‘right’ from party & prospect management.

- Rating → Extend ‘up and out’ from pricing into the underwriting flow.

- IDP/Submission Extraction AI Tools → Add workflow and business rules within triage.

- Low-code/No-code → Build your own solution ‘across’, usually orchestrating tools above.

- Underwriting Platform (e.g. Send) → purpose-built solutions designed to digitise and modernise the pre-bind process.

All these tools have their place, with relative strengths and weaknesses, but as the battle for control of the underwriting space intensifies, the boundaries are blurring.

Our experience, as we near 20 customer deployments, is that an independent underwriting platform offers the flexibility, extensibility, speed to value, and right balance between company-wide standardisation and line-of-business specificity needed to compete and thrive in the complex risk market.

The value propositions of each option are well documented, so instead let’s explore the challenges I’ve seen/heard with trying to use these tools as overall workbenches based my discussions with dozens of carriers over the last two years. This clearly isn’t an impartial perspective, but that doesn’t mean it’s wrong! No doubt plenty will have differing views and we welcome the discussion. 😊

Why traditional CRM and Policy Admin platforms fall short

We’ll group CRM and Policy Admin solutions together as their challenges are the same – they are not really built for underwriting. They are architected for managing relationships and transactional data across industries and markets, not the nuanced demands of London Market underwriting. While critical for compliance and record-keeping, these platforms are not designed for productivity. They often provide a poor user experience for underwriters and do little to streamline day-to-day workflows or provide the data orchestration needed. The leading vendors will tell you they have low-code configuration capability or are investing in it – but the reality is it’s not their focus, and you’ll be twisting the system to fit.

These platforms lack the flexibility, relevant out-of-the-box (OOTB) features, and operational depth needed for complex underwriting, resulting in longer implementation timelines, higher costs, and limited roadmap relevance. Real-world market upgrades often reach into the tens of millions, with only a fraction dedicated to underwriting innovation – making these tools poor strategic bets in specialty lines.

These options are generally only considered by larger insurers that are already spending significant sums for an enterprise license across markets. Business leaders are getting pressure from group functions and the vendor account managers to adopt the platform for synergies that won’t appear. These options haven’t gained much traction and limited, if any, true success stories in the London Market; and people don’t want to be an expensive guinea pig.

Rating engines: powerful but specialised

Modern digital rating platforms are fantastic for delivering better pricing models and a big step forward for the industry. These solutions support consistent model-building, an underwriter-friendly experience, and the connectivity to integrate pricing into the underwriting flow - but they aren’t the best solution as a holistic underwriting platform for several reasons.

The main one is that it erodes the independence and dynamism a standalone digital rating tool gives – reducing its value. In general, CXOs are actively working to decouple rating from their core underwriting operational workflow because they recognise that how they rate is a critical differentiator. It should be free to evolve per business needs, either with new logic or a new tool if that fits better for that line, channel, or market. Building workbench features into your rating tool takes away this flexibility and speed of change. Raters are one of the areas where it’s clearly critical to be highly tailored to each line, which leads to the second challenge…

In the absence of another underwriting platform, teams extend the scope of the rating tool beyond pricing. As rating development is led by individual actuarial/underwriting teams on a per-class basis, the extra operational scope is developed that way, too. Whilst this maintains the tight alignment to specific lines, it essentially means building a custom ‘workbench’ for each line of business. This results in fragmented processes, operational inefficiencies, lack of transparency and a single view of the customer – in short, it perpetuates the siloed hybrid ‘raters come tracker Excel’ models that the market wants to move on from.

So what starts as a seemingly logical ‘quick win’ ultimately slows the speed of change, and increases maintenance costs, especially as the tools lack the full breadth of operational features needed to support overall underwriting. These point solutions can’t be the orchestration engine that insurers need to unify data and workflows to accelerate underwriting.

The danger we’ve seen with this pattern is that these issues can happen by stealth rather than a conscious strategic decision. As local underwriting teams enjoy success in the core rating use case, they are tempted to continuously add ‘just one more’ piece of functionality - ultimately resulting in a new form of siloed monolith. Combined with an independent underwriting platform however unlocks the full power of rating engines without the compromise.

Intelligent document processing (IDP)/Submission extraction AI: buzzy, important, but only a part of the overall puzzle

Data is the key to maximising value – whether it’s for speed, insights or efficiencies. The absence of timely, structured data is therefore clearly a major obstacle. It is unsurprising that some insurers view the data extraction/submission intake process as THE solution or, at the very least, the logical starting point.

Firstly, data on its own delivers no value. It needs to be used first – it needs to be connected with other data sets, compared to underwriting appetite, and fed to other internal/external systems. Therefore, an IDP without an underwriting platform is unlikely to deliver any real value to underwriters and risks losing business focus. Given how cost-effective BPO services can be, it’s also challenging to build a strong business case on that alone.

Secondly, AI is moving at a serious pace. Are the current leading vendors going to be leading in a year? Are they the best tool for every line?

Thirdly, while the evolution is taking its time, digital placing and API exchange of risk data is undoubtedly gaining more and more traction, led by Broker digitisation, facilitation, algorithmic follows and STP quote of productised, and lower value specialty lines. So extraction from emails is only part of the Submission Intake puzzle – still the lion's share today, but over a 3-5 year time horizon, this will evolve.

Pull those three things together, and you can see why IDP vendors have started to evolve their marketing and feature sets into the workbench space, namely triage decisioning and integration to other systems, generally rating. This is not what they were originally architected for, and they tend to lack the operational breadth required to support the whole underwriting process. If you want data and integration orchestration, there are clearly better solutions for that.

The bigger challenge, however, is inflexibility. Building your underwriting flow around a single IDP solution restricts your ability to evolve as conditions change without disruptive business change. Where do you go if you want to use a different, better tool in 18 months for say, Aviation? Do you need to use another tool to manage submissions from digital channels? Does it handle different facility structures?

These tools are powerful but best kept to their core use case of extracting data.

Self-build, Low-Code/No-Code platforms: tempting sales pitch but track record of failure

The allure of low-code/no-code platforms is their simplicity, promise of quick wins, and enterprise control. Countless experiences show that what starts as a “simple workflow” that demos well in a proof of concept (POC) often requires extensive, costly customisation as requirements grow. Aside from the numerous carrier initiatives I’m aware of I’ve also got personal experience of building a scaled application using low-code.

This isn’t to say low-code platforms don’t have their place - far from it, they can be useful for several use cases - the problem is they just aren’t right for end-to-end London Market underwriting because of its scale and complexity. Low-code is great for spinning up a series of relatively simple, standalone or very loosely coupled apps; once you go past a certain application scale, however, you effectively lose all the benefits of the low-code platform. You’ll be slowed by performance issues and the complexity of regression testing a complex web of integrated upstream and downstream business logic.

While the headline placement journey appears simple, the reality is that there are countless variations of risk structure, placement type, rating factors, product structures, referrals, etc. The challenge is that these tools are not built specifically for insurance, let alone complex commercial and specialty insurance. Delivering real value requires heavy reliance on system integrators, and projects often see professional service costs balloon as a result. If there was no existing market tools to support that journey then self build is the only reason… but that isn’t the case.

This can still be a valid choice if your company has the skills, funding, and patience to do a self-build – just know what you are getting into. Sadly, too many carriers have ‘drunk the sales Kool-Aid’ – expecting underwriters to build workflows – only to launch MVPs over a year late, millions over budget, and left with the ongoing burden of maintaining and evolving complex bespoke tech. The challenge is these realities only get clearer as time goes on – at which point the cost, elapsed time, and personal reputations become an increasing barrier to change. Companies with £20m+ to spend and are willing to invest 2-3 years in building and rolling out a strategic platform may still view this as a good option – but as only a small subset of the functionality is differentiating, they’ll struggle to realise value and risk distracting their underwriters for an extended period.

The purpose-built Underwriting Platform: strategic advantages

A purpose-built, smart underwriting platform, engineered for underwriting complex risks, offers the greatest advantage to London Market carriers. It’s not perfect in every category (there are no silver bullets in this space), but it provides the best overall balance – or if you prefer – it has the fewest compromises! They focus on standardising what is standard and providing flexibility where needed. The key strategic benefits:

- Flexibility and extensibility: orchestrates best-in-breed rating, data enrichment, document production, policy admin, sanctions, and LLM tools, without locking the business into rigid workflows or set tooling.

- Standardisation with line-of-business specificity: enables carriers to define standard enterprise underwriting processes while tailoring data sources, workflow logic, and automation by line of business, helping to unify data, processes and people.

- Speed to value and ease of maintenance: don’t recreate the wheel in areas that won’t differentiate you. Leverage the OOTB features to accelerate both initial MVP launch and full rollouts to unlock value sooner and reduce ongoing maintenance costs.

- Future-proof innovation: supports the evolution from traditional to augmented and algorithmic underwriting at the right pace for each business unit—whether open market, facilities, delegated authorities, or treaties.

- Single view of risk and customer: delivers a unified, scalable solution for all placement types, ensuring that the shift towards delegated authority, MGUs, broker platforms, and data-first underwriting happens without fragmentation.

As I always say to prospects there is no silver bullet in this space, and so this option isn’t perfect either. For the speed to value and lower cost of maintenance, there is a compromise on solution flexibility: for example, there is a UI framework you will work within. This restriction is generally overstated; tarnished with the brush of ‘off the shelf’ or ‘buy’ monolithic solutions of the past (2000s London Market PAS anyone?).

As long as the tech has the flexibility where it matters – data, process, integrations, including rating, business rules, AI agents – then working within tried and tested frameworks for standard areas is a worthwhile. There is no turnkey solution that fits every business, but there is more commonality than difference!

Orchestrate a best-of-breed ecosystem with Send

Send has established itself as the category-defining underwriting workbench. We are more than just an underwriting tool - we are that digital representation of our customers' complex underwriting operating models. If you do it, we’ll support it. That ability to support the entire underwriting lifecycle, across lines, across channels, placement types and risk structures is unique. You can read more about how we’ve done exactly that in partnership with Argenta here. That’s one of the things set’s us apart from other specialist ‘workbench’ tools built for more simple lines.

But this isn’t about being a single all-encompassing solution like the monoliths of the past. Our data and API-first ethos (Send was originally a data exchange) allows us to orchestrate a best-of-breed solution, tailored for each customer and line, on a single unified solution. So Send pairs with your chosen rating platform, your PAS, your CRM, exposure management and existing AI models/solutions – use the best tool for each job.

This gives insurers the tools to unlock their value – growth, risk selection, market entry, efficiency, controls – without compromising another area of their business.

Industry perspective and trends

Recent cross-industry thought leadership reinforces the move away from monolithic, legacy software and toward composable, “ecosystem-ready” platforms. And underwriting is no different. Modern carriers seek tools that align with dynamic market needs - digital placement, an evolving portfolio landscape, augmented decisioning and seamless data orchestration - rather than “one size fits all” platforms that slow growth or create silos.

This aligns with and guides Send’s long-standing focus on flexibility, scalability, and integration, matching the direction in which leading insurance operations are moving. Our platform is the orchestration engine that unifies data and workflows to accelerate underwriting. It enables insurers to put risk data at the centre of their underwriting decisions and support their shift from process-centric to data-centric.

Conclusion

An independent, end-to-end underwriting workbench is the strategically sound choice for insurers, and Send is the category-defining solution for the London Market.

It delivers essential flexibility, future-proofs carrier operations, and supports the nuanced blend of standardisation and line-of-business specialisation required to innovate and lead in specialty insurance. Orchestration and adaptability trump legacy lock-in, and a dedicated platform is the backbone of successful, data-rich underwriting transformation.

Are you curious about the workbench landscape? Let’s explore how Send can give your underwriting teams the flexibility and power to lead in the London Market.

By Lloyd Peters, Head of Revenue (UK & EMEA) at Send.

Connect with Lloyd on LinkedIn.

- Insights

Related Resources

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026