InsurTech Send launches Smart Submission product to increase insurers' submission-to-quote ratios

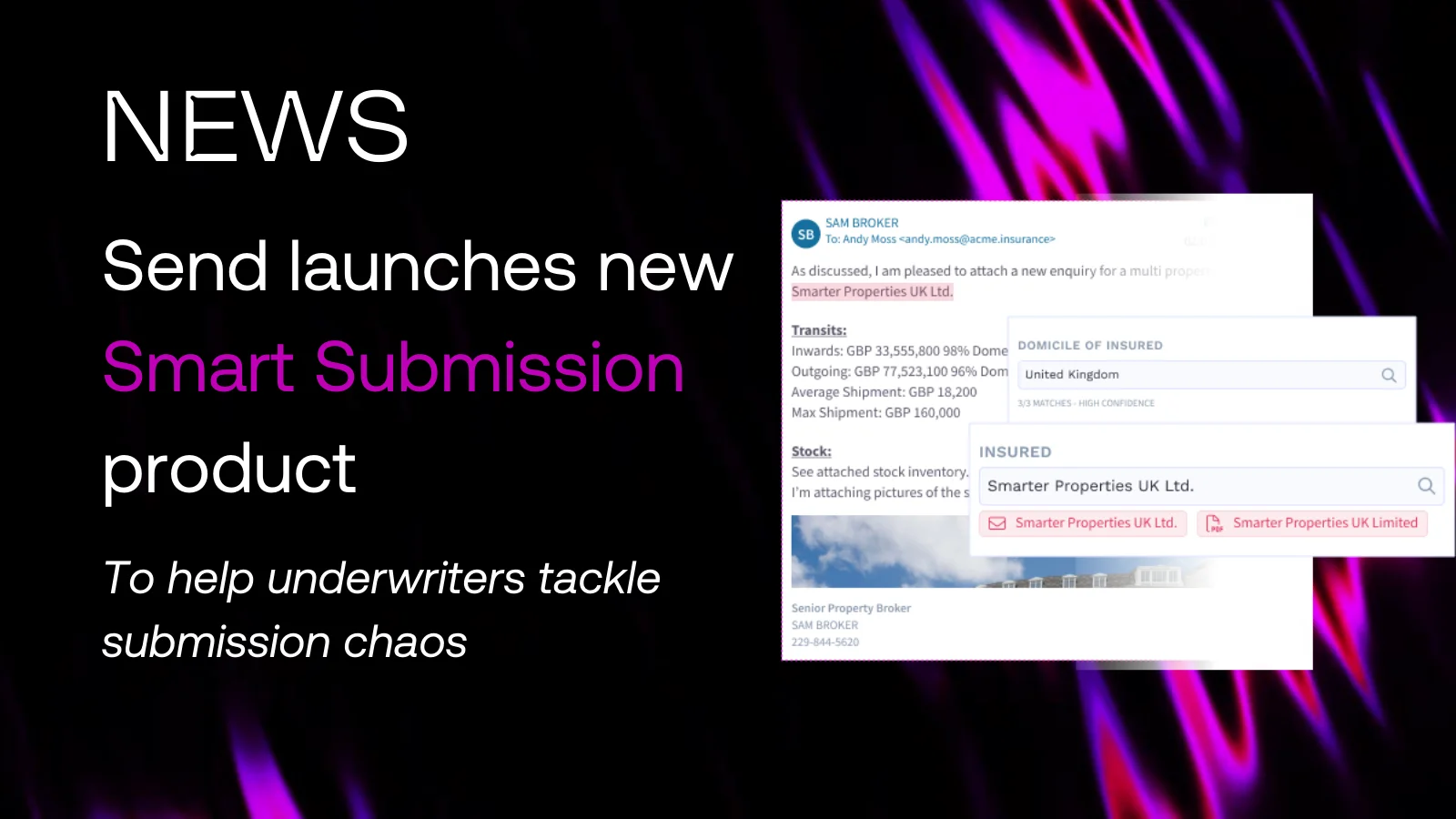

June 27th 2023 – Leading InsurTech Send Technology Solutions Ltd (Send) has launched its latest product for underwriters, Smart Submission. Smart Submission uses generative AI to help insurers save time and increase their win rate by automating the submission process.

Smart Submission has been developed by Send in response to one of the biggest pain points facing today’s underwriters, the onslaught of unstructured submission data received via email. Smart Submission uses best-in-class data ingestion technologies and generative AI to provide intelligent automation that extracts data in seconds from any format. Insurers benefit from a single inbox where submissions are rapidly ingested, classified and triaged. This helps insurers quickly prioritise risks in appetite to improve submission-to-quote ratios.

Features include data enrichment to give underwriters more detailed information on the risk, a triage board to automatically allocate tasks for review, and risk creation capability that feeds through to either Send’s own Underwriting Workbench, or to the customers’ existing platform.

Co-founder and CEO of Send, Andy Moss commented:

“Underwriters are under increased pressure to write profitable risk. But they struggle to do this whilst they’re battling submission chaos and multiple admin-heavy systems that require manual extraction and re-entry of risk data. It is one of the single biggest pain points facing our insurer and MGA customers writing commercial and specialty business.

Smart Submission will not only speed up the ingestion process but will help them to greatly improve underwriting performance.”

Smart Submission is available as a stand-alone product or as part of Send Underwriting Workbench.

Send Underwriting Workbench is a smart underwriting platform that brings together submission triage, quote management, task workflow, audit and compliance, rating and MI reporting into a single platform. It streamlines processes and frees up underwriters to focus time on selecting the best risks and building relationships rather than struggling with submission chaos and siloed data.

ENDS

For more information, contact:

Kirsty Plank: kplank@fullcirclecomms.co.uk, +44 20 7265 7887

Notes to Editors:

About Send:

Send is a rapidly growing InsurTech software company based in London with global reach. The company has developed an innovative connected workbench that enables re/insurers and MGAs to automate, streamline and optimize their underwriting operations. It’s a modular platform that gives teams everything they need to be more productive, in one place - a single platform for managing new business, renewals and endorsements.

The SaaS platform brings complex data out of silos into one solution, providing a consolidated view throughout the lifecycle. Its automation enables new and mature carriers to eliminate rekeying, improve predictability, and work smarter.

- Product Announcements

Related Resources

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026