Trusted by insurers and MGAs all over the world

More than technology

To enable underwriting innovation, insurers need to combine technology and a partner who can accelerate their underwriting strategy.

Send helps insurers shape their underwriting strategy with an underwriting workbench that standardises complex underwriting processes and expertise to encourage data driven underwriting.

We have developed innovative submission and workbench platforms that combine a deep understanding of how to evolve their underwriting.

Built for Insurers & MGAs

Insurers

We help you automate and streamline operations. Designed for the complex commercial and specialty markets you operate in, our platform helps your underwriting teams drive growth.

Solutions for InsurersMGAs

We help you optimise your underwriting operations. Designed for MGAs, our platform helps your teams work smarter and faster, so you can focus on accelerating growth.

Solutions for MGAsProducts

Send provides insurers and MGAs with products to grow and scale with confidence.

Smart Submission

We recognise that organising submission data is critical to the success of your underwriting process. Smart Submission helps automate and organise unstructured submission data.

Learn more

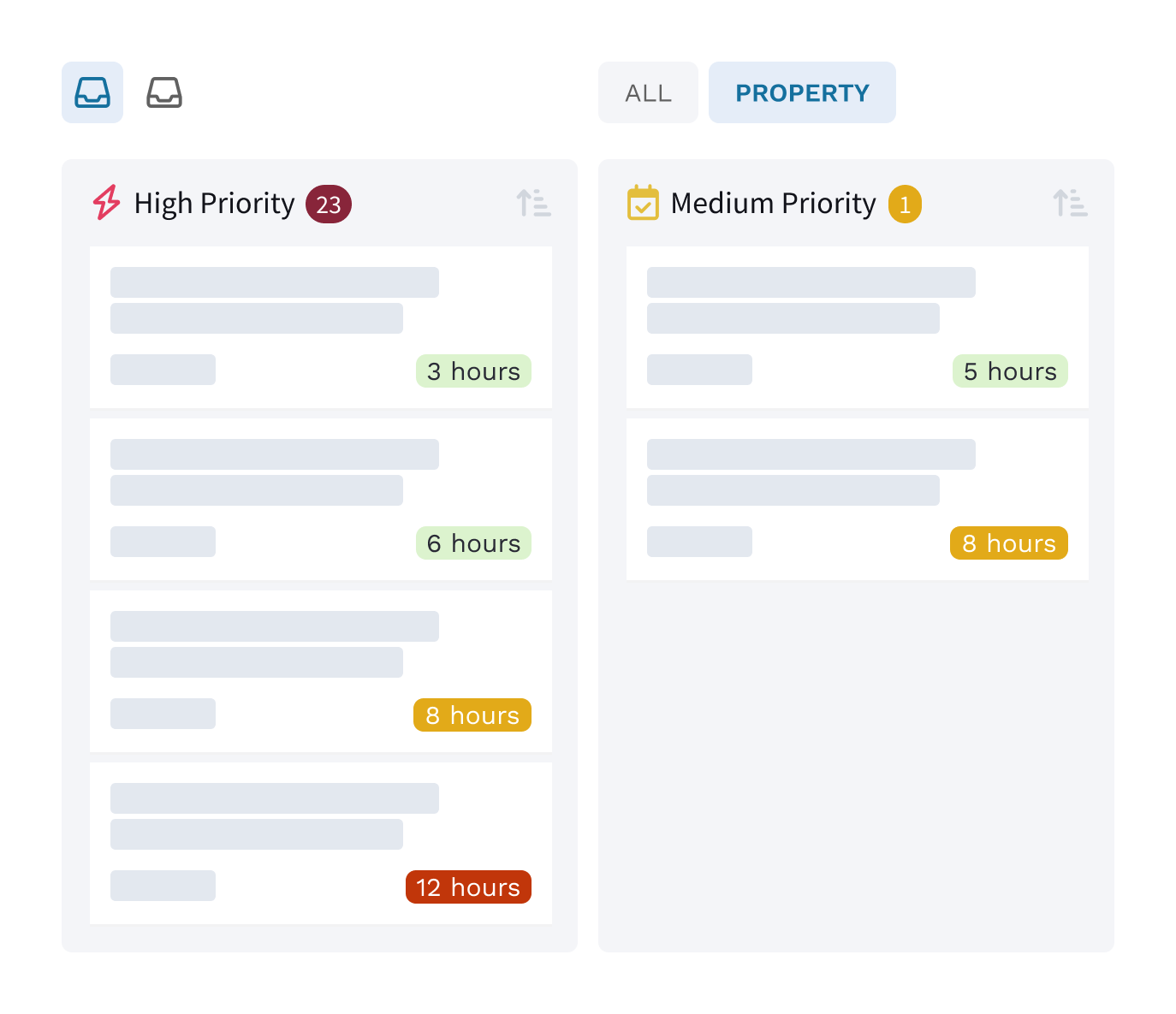

Underwriting Workbench

A single platform designed to manage the underwriting process from submission to bind, and beyond.

Learn more

Delegated Underwriting Authority

Integrated coverholder, binder and bordereaux management built within our Underwriting Workbench to manage delegated business.

Learn more

Components

Standard

Included as part of our Underwriting Workbench

Premium

Specialised components that can seamlessly connect to our Underwriting Workbench

Standard

Included as part of our Underwriting Workbench

Premium

Specialised components that can seamlessly connect to our Underwriting Workbench

News

Send named a Leader by IDC

Send has been named a Leader in the IDC MarketScape: Worldwide P&C Intelligent Underwriting Workbench Applications 2023 Vendor Assessment.

“Send Underwriting Workbench is an insurance-focused solution that sets itself apart with its comprehensive features, offering a seamless and intuitive user experience.”

23rd April 2024

Send appoints new Head of Business Strategy and Customer Success

23 April 2024 - Leading InsurTech Send Technology Solutions Ltd (Send) has appointed William Harnett as its Head of Business...

Read More19th April 2024

Operational steroids: How APIs will make or break underwriting

Manual processes have plagued the insurance industry for decades. Underwriters spend countless hours sifting through data and paperwork. Application Programming...

Read More