Run a high-growth MGA

without operational drag

Designed to support MGA growth as premium volumes and complexity increase

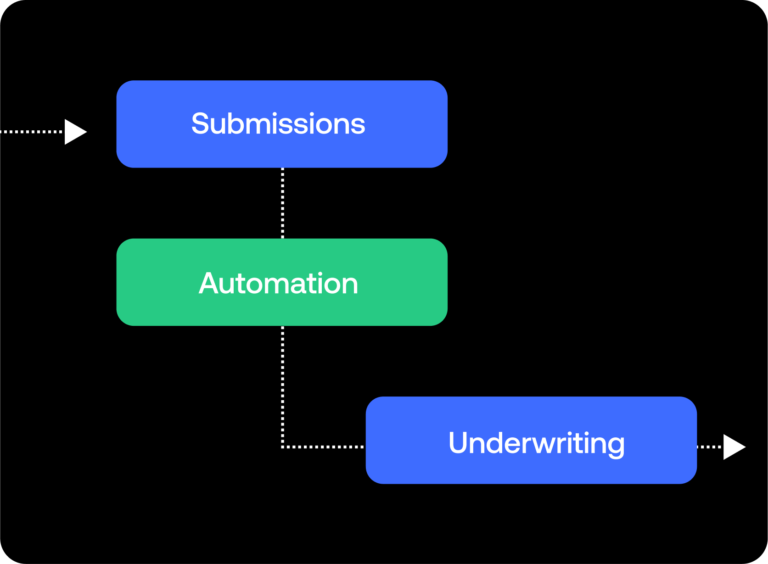

MGAs compete on speed and precision, yet underwriters are often pulled into chasing documents and updating spreadsheets instead of assessing risk.

Send helps MGAs move faster as volumes grow, protecting underwriting focus while adding

structure and control – without introducing operational friction.

Drive growth with new business, renewals and endorsement data all together in a single platform.

MGA BENEFITS

Scale premiums without the overhead

As you write more business, the admin usually grows with it.

Send reduces repetitive work across intake, triage, document production, and follow-ups so the same team can handle more submissions and bind more risks.

A platform that accelerates business growth

Remove the barrier to growth with flexible and scalable solutions through our API-first platform.

Connect the third-party apps you need to move data seamlessly across your underwriting workflow.

Move fast when opportunity shows up

Speed wins business only if you can keep up.

Deploy quickly and expand as you grow. Intake, routing, and automated documents help teams act faster and deliver a better broker experience.

Controls for more capacity

Capacity is built on consistency and trust.

Our platform helps you evidence portfolio oversight with consistent data capture, structured workflows, and clear auditability that supports bordereaux, compliance, and partner reporting.

Products for MGAs

The underwriting platform built

to help MGAs scale

Support carrier confidence with clear data, consistent processes, and transparent reporting.

Add more power to your underwriting

Specialised functionality to enhance how your teams work and unlock deeper capabilities as your needs evolve.

Send Rating

Connect your preferred pricing tools directly to the underwriting workflow.

Send Studio

Document generation and management for quotes, wordings, and binder packs.

Pre-built workflows and data models for more than 40 lines of business

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026