Improve your submission-to-quote ratio

Respond to the right risks first, with workflows that keep your submissions organised and teams focused.

Organising submission data is critical to the success of your underwriting process.

Submission Management connects email accounts by line of business and brings intake into a unified workflow view.

With shared visibility, configurable SLA logic, and integrated tracking, teams respond faster from first touch to quote.

Too many submissions get delayed or duplicated because the inbox isn’t a system.

Our platform helps you prioritise risks in appetite, saving you time and increasing your win rate.

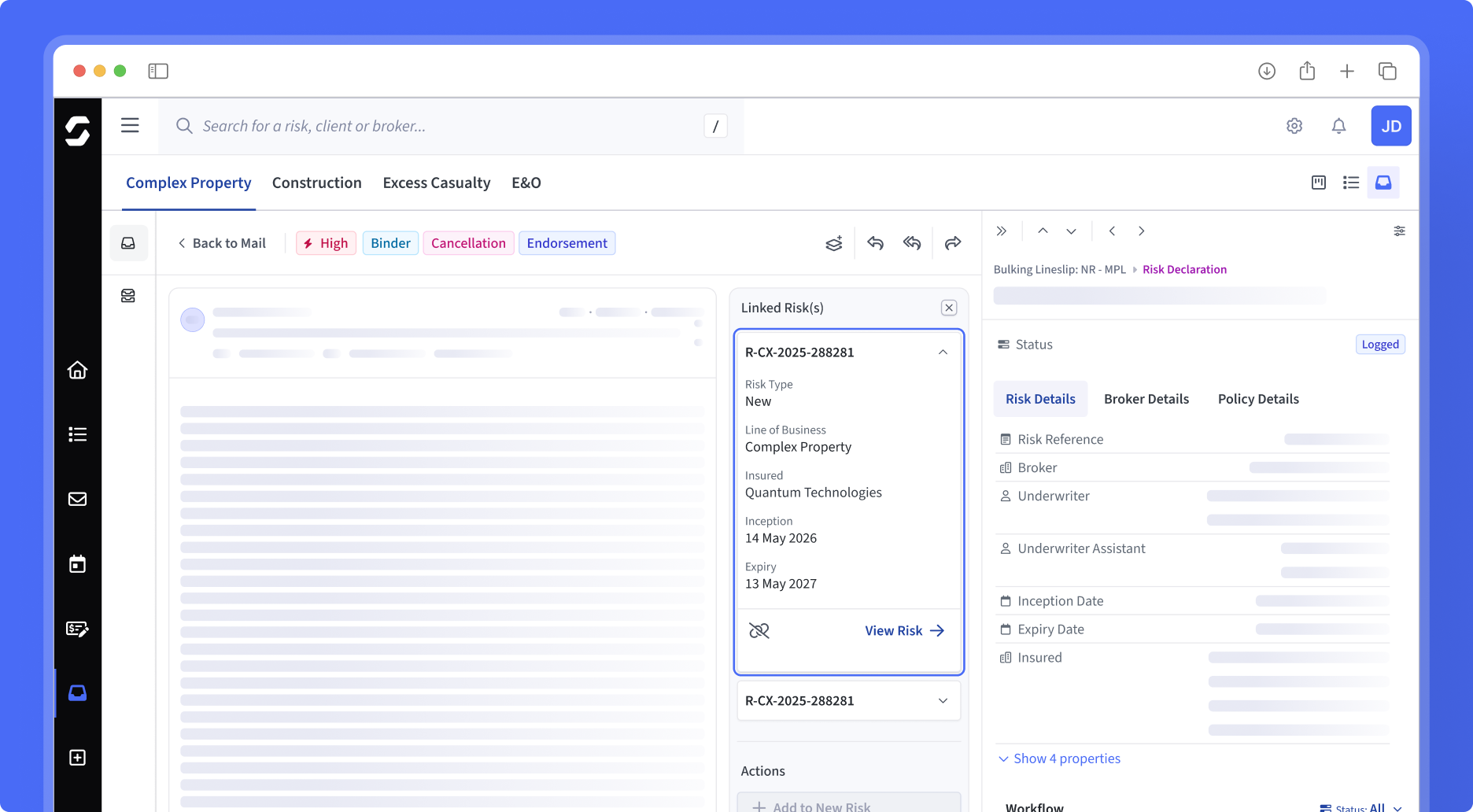

Unified inbox

Give teams a real-time view of a shared inbox built into the underwriting workflow.

Reducing fragmentation and improving coordination.

Inbox management

Triage, prioritise, and manage submissions with consistent workflow handling.

Keep submission intake organised as volumes increase.

Submission visibility

Track the status of your submissions at an individual and team level to spot bottlenecks.

Improving your submission efficiency and throughput.

SLA management

Set SLA rules and logic to manage timing and prioritisation.

Helping teams stay responsive without manual policing.

Enhanced Capabilities

Specialised functionality to extend your core capabilities.

Send Flow

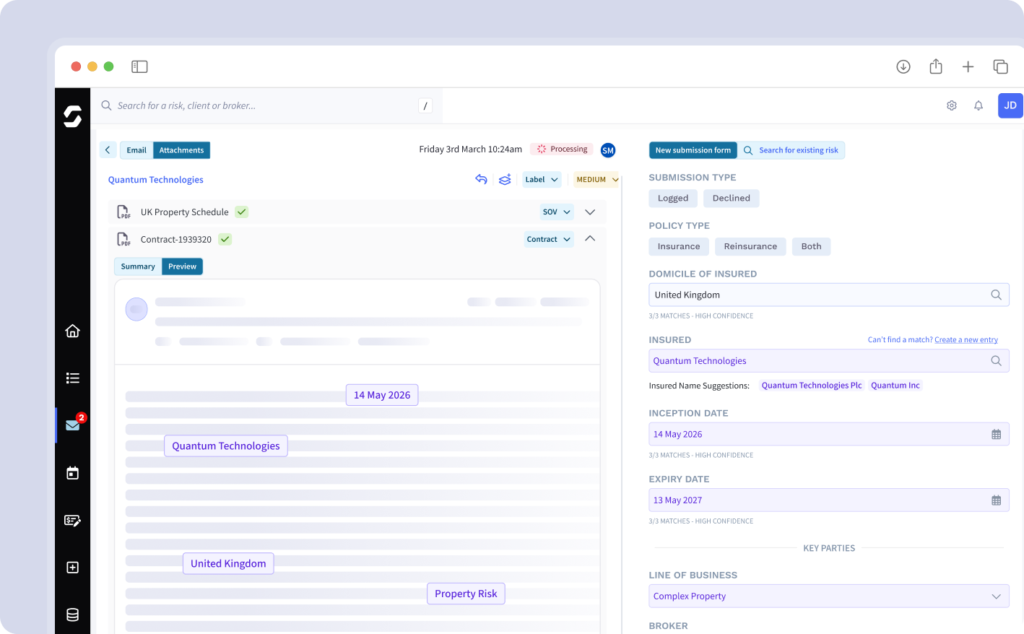

Add AI-powered submission processing for faster underwriting with Send Flow.

Every carrier wants faster submissions, lower costs, and less manual effort.

But commercial and specialty risks are complex, and submission data rarely arrives in clean, structured formats.

Send Flow applies intelligent automation to organise and validate submission data at the point of intake. Routine steps are handled automatically, while underwriters stay in control of the decisions that matter.

The heavy lifting is removed. Complex tasks are simplified. Every submission becomes easier to process.

The result: cleaner data, faster triage, and greater confidence in every underwriting decision.

Underwriting that works together.

Customer spotlight

Building a future-proof underwriting platform – Argenta's transformation with Send

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026