Designed for insurers and MGAs

writing open market business

Insurers face complex risks, competitive pressure, and tight placement deadlines – all at once.

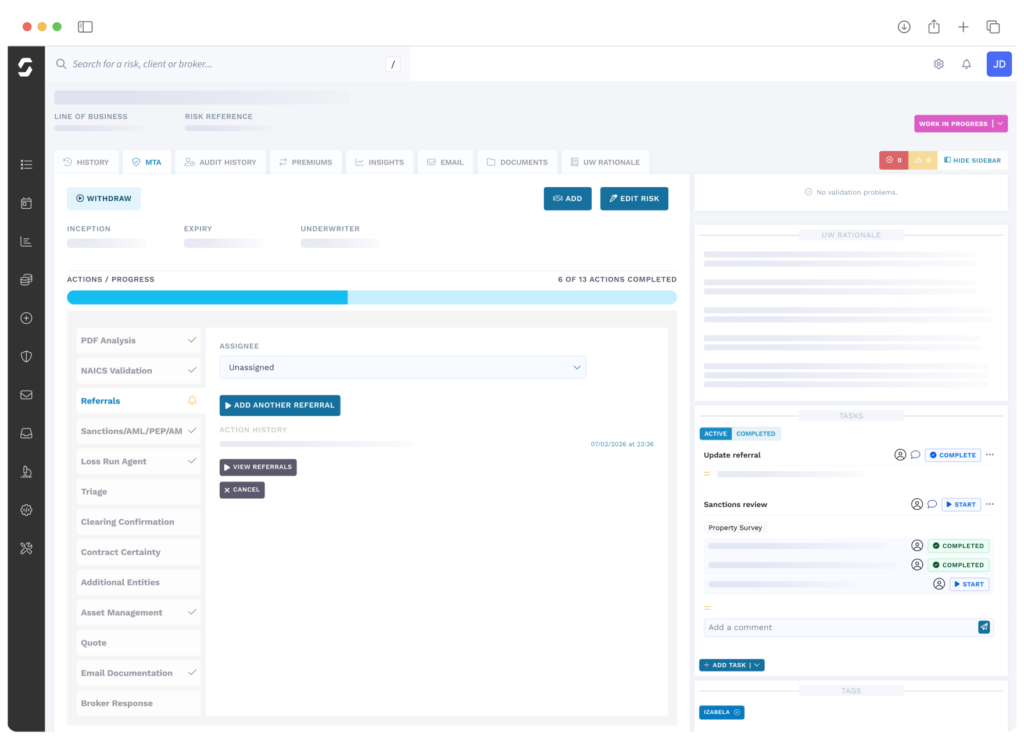

Send connects underwriting data, workflows, and decisions so teams can underwrite faster, from submission to bind and beyond.

Trusted platform for leading insurers

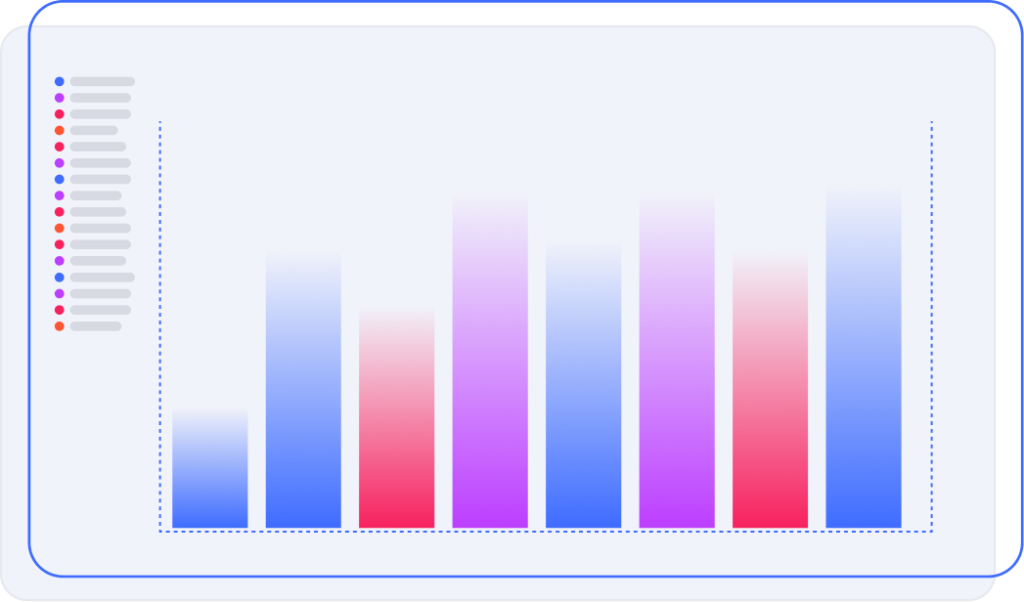

See your portfolio clearly – and respond to trends before the market does.

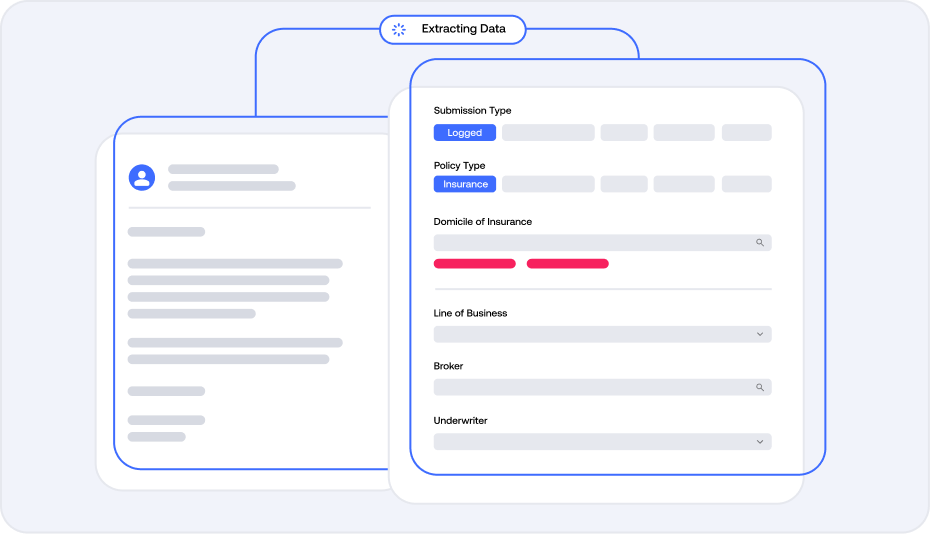

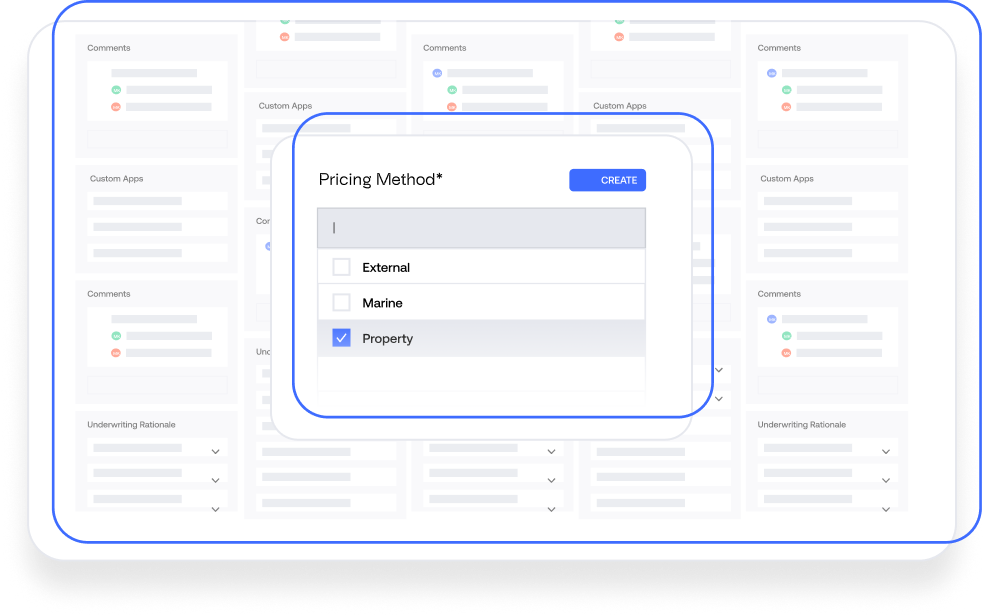

Control submission intake from the start.

Automate data extraction, organise unstructured information, and capture complex asset details – so underwriters begin with clean, decision-ready submissions.

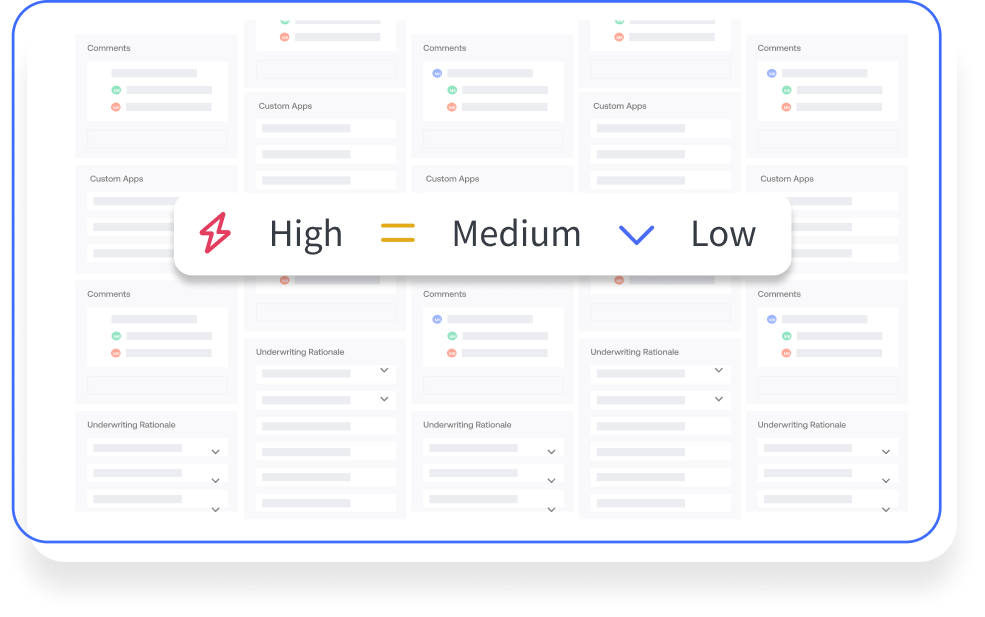

Focus effort on the risks that matter.

Prioritise submissions early using triage aligned to appetite and likelihood to convert, ensuring the best opportunities are worked first.

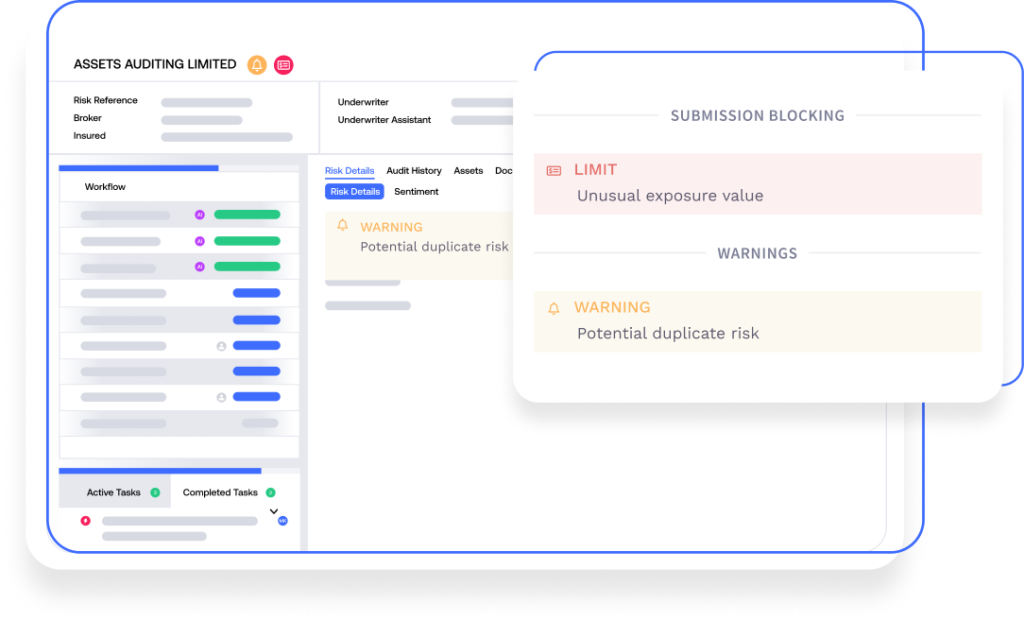

Make better decisions, faster.

Bring the right data into the moment of decision. Underwriters can analyse and interrogate risk data quickly, with context that stays tied to the record.

Handle complex risks with confidence.

Purpose-built for commercial and specialty underwriting. Proven across 40+ lines of business, Send supports complex structures and workflows without adding friction.

Price and bind with built-in control.

Connected rating, referral logic, and an insurance-native data model deliver confidence, oversight, and auditability at the point of pricing.

See your portfolio in real time.

Track quotes, conversion, exposure, and appetite fit as it happens – giving underwriting leaders continuous visibility and control across the book.

40% of an underwriter’s time is wasted on admin. Imagine what your underwriters could do with more time.

Designed to help you write better business.

Send gives you a faster path to better underwriting. Send for Direct Underwriting brings proven workflows, connected APIs, and automation that cuts admin so underwriters can focus on what they do best – underwriting!

Get to value sooner.

Templates, libraries, and line-of-business workflows take years to build on your own. Send gives you proven journeys you can configure quickly.

Composable by design.

Pre-built services and APIs help you adapt, integrate, and scale without re-platforming.

Faster underwriting.

Automate the manual steps that slow teams down. Better data and controlled workflows mean faster turnaround with fewer errors.

What our Customers Say

"Send enables us to capture data differently and uncover insights that support faster, more informed decisions."

Who is this for

Insurers

Transform your underwriting with a data-driven underwriting platform built for the complex commercial and specialty market

MGAs

Regain control on core work that drives growth with new business, renewals and data all together in a single platform.

Add more power to your underwriting

Specialised functionality to enhance how your teams work and unlock deeper capabilities as your needs evolve.

Send Rating

Connect your preferred pricing tools directly to the underwriting workflow.

Send Studio

Document generation and management for quotes, wordings, and binder packs.

A full API library to accelerate your

growth and scale your operations.

Using our API-first architecture, underwriters can collect data once and ensure it remains accessible throughout the process, with ready-to-use data sources like HX, D&B, Hazard Hub, and many others.

Pre-built workflows and data models for more than 40 lines of business

Underwriting Resources

Underwriting Maturity Framework: Moving from a process-driven to a data-driven operating model

Top 10 insurance industry trends shaping underwriting in 2026